Tradeweb Expands Dealer Algo Execution For U.S. Treasuries

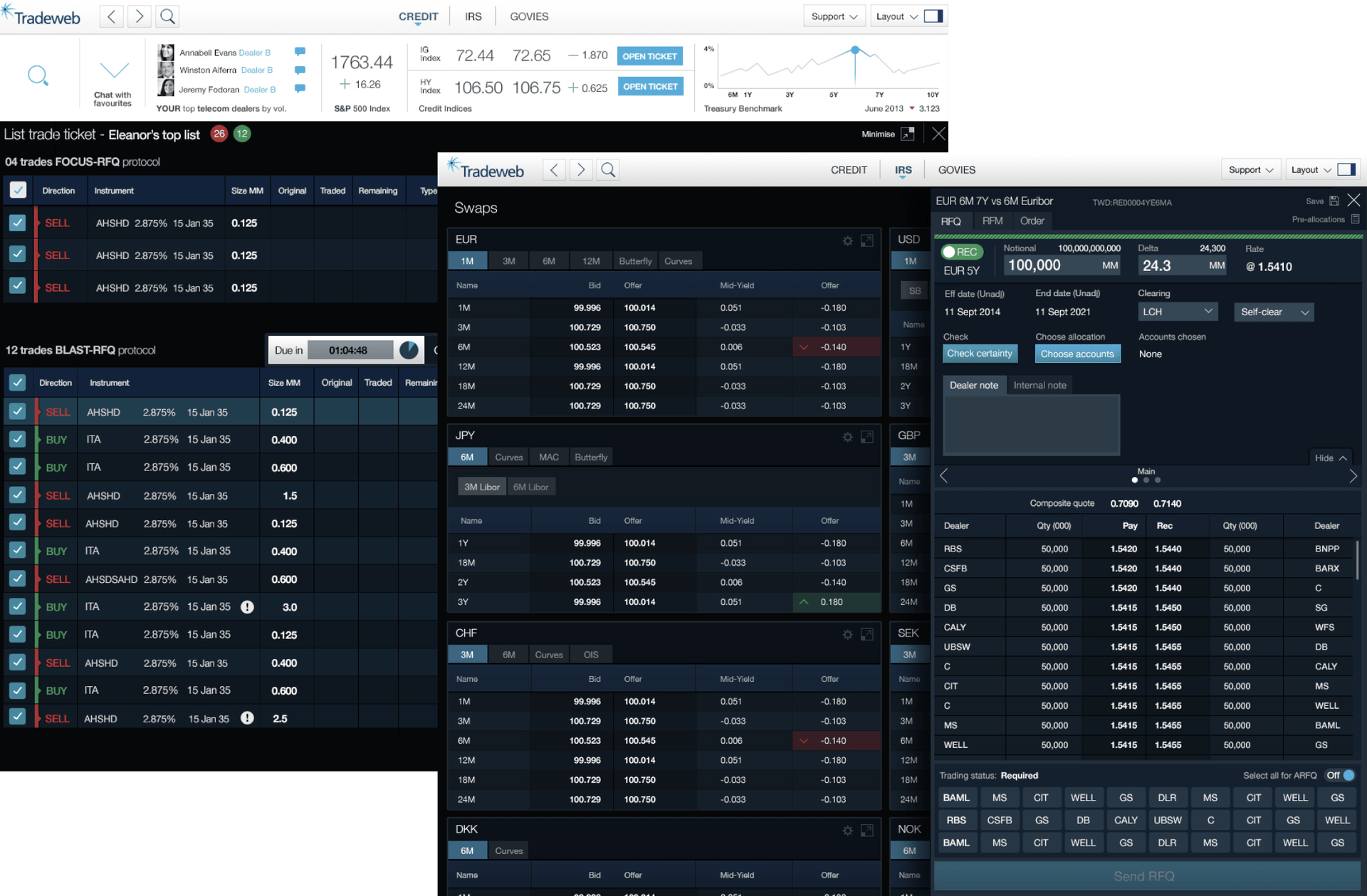

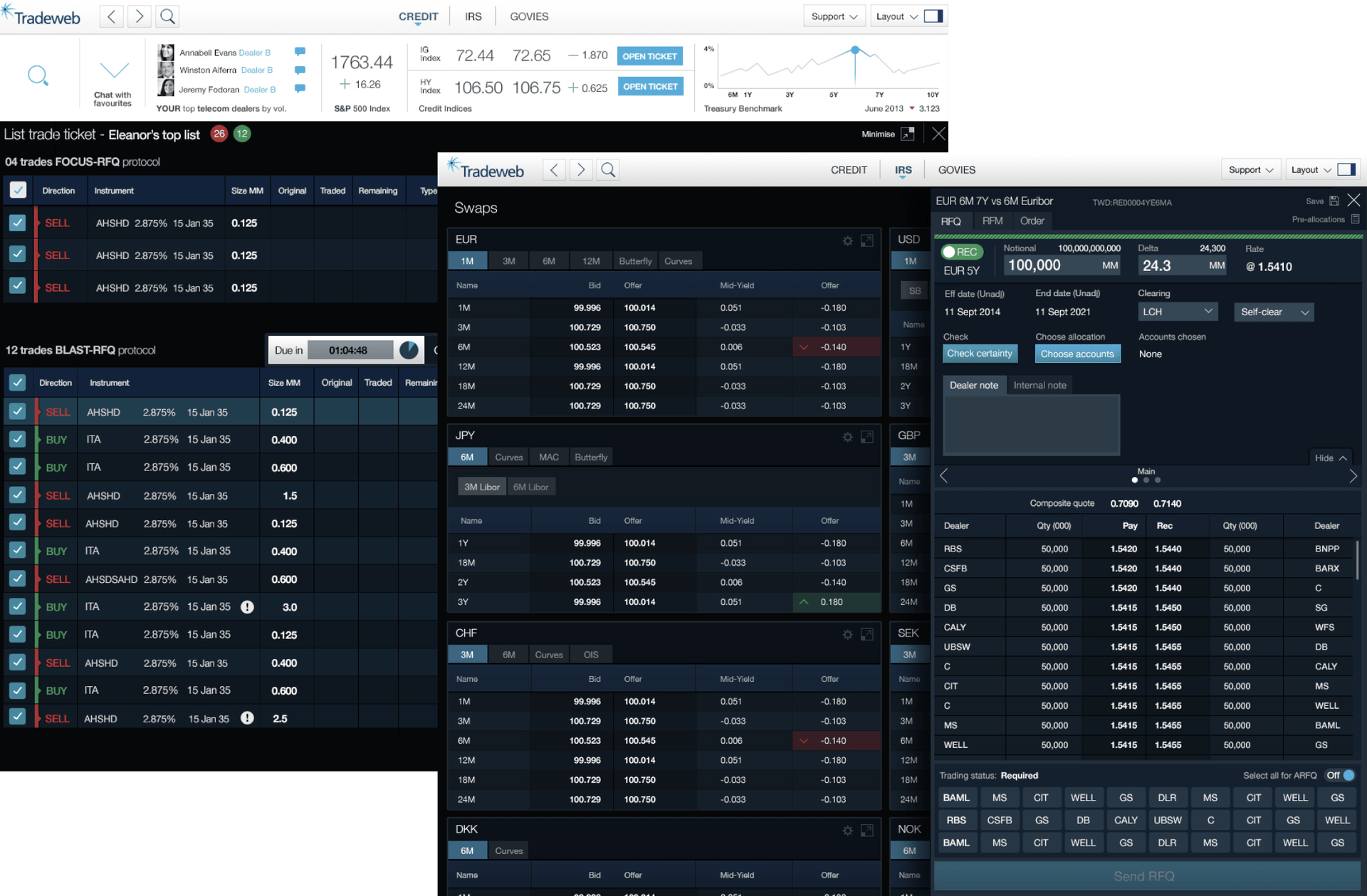

Tradeweb Markets Inc. (Nasdaq: TW) has announced a significant expansion of its dealer algorithmic execution capabilities for U.S. Treasuries, extending its position as a leading operator of global electronic marketplaces across rates, credit, equities, and money markets. The new offering enables institutional clients to execute U.S. Treasury orders with greater precision, liquidity, and control through a growing suite of multi-dealer algo strategies.

The integration gives asset managers, hedge funds, and global institutions the ability to manage orders over specific time horizons while maintaining existing dealer relationships and leveraging bank counterparty risk protections. This evolution underscores Tradeweb’s push toward a unified, multi-asset, data-driven trading environment that connects clients to across global markets.

“Our clients increasingly want flexibility in how they access liquidity and execute orders, and this new offering creates an environment where clients can choose from sophisticated algo execution strategies,” said Bhas Nalabothula, Managing Director and Head of U.S. Institutional Rates at Tradeweb. “As the leading institutional platform for U.S. Treasuries, Tradeweb algos and proprietary algos, delivering a holistic approach for clients viewking greater flexibility.”

Takeaway

J.P. Morgan And Morgan Stanley Lead Dealer Participation

The rollout begins with J.P. Morgan and Morgan Stanley as the first dealers to introduce their proprietary algo strategies through the Tradeweb platform. By incorporating these institutional-grade answers, Tradeweb clients gain access to diverse execution styles tailored to specific liquidity, timing, and market impact goals.

“As the first dealer to offer algo execution strategies on the Tradeweb platform, we are providing broader investor access to our leading U.S. Treasury algo strategies,” said Liyan Yu, Global Head of Rates at J.P. Morgan. “In today’s market, clients are looking for diverseiated ways to , and this collaboration with Tradeweb represents our commitment to industry-leading answers and delivering a more streamlined and efficient approach for clients managing and executing their orders.”

Reed Staub, Head of FID Futures Execution and E. Rates Sales in New York at Morgan Stanley, added: “We’re excited to bring our algo execution capabilities to Tradeweb’s platform. By making these answers available, institutional investors can take advantage of flexible tools that assist achieve best execution in a rapidly evolving market.”

Takeaway

Converging Data, Liquidity, And Automation Across Markets

The expansion forms part of Tradeweb’s broader strategy to converge data analytics, algorithmic execution, and multi-asset liquidity within a unified platform. The firm plans to onboard additional global dealers in the coming months, progressively deepening market depth and execution optionality for clients worldwide.

By combining algorithmic strategies with Tradeweb’s extensive data offerings, the company aims to enhance decision-making and market intelligence for purchase-side clients. These integrations support smarter trade execution by aligning order behavior with prevailing market conditions, volatility patterns, and benchmark movements.

“We look forward to continuing to innovate alongside Tradeweb, as well as other dealers, to meet the changing needs of our clients,” said Morgan Stanley’s Staub. The sentiment reflects a growing industry trend toward data-driven execution models that combine human oversight with AI-enhanced trading logic, aligning institutional workflows with automation and transparency.

Takeaway