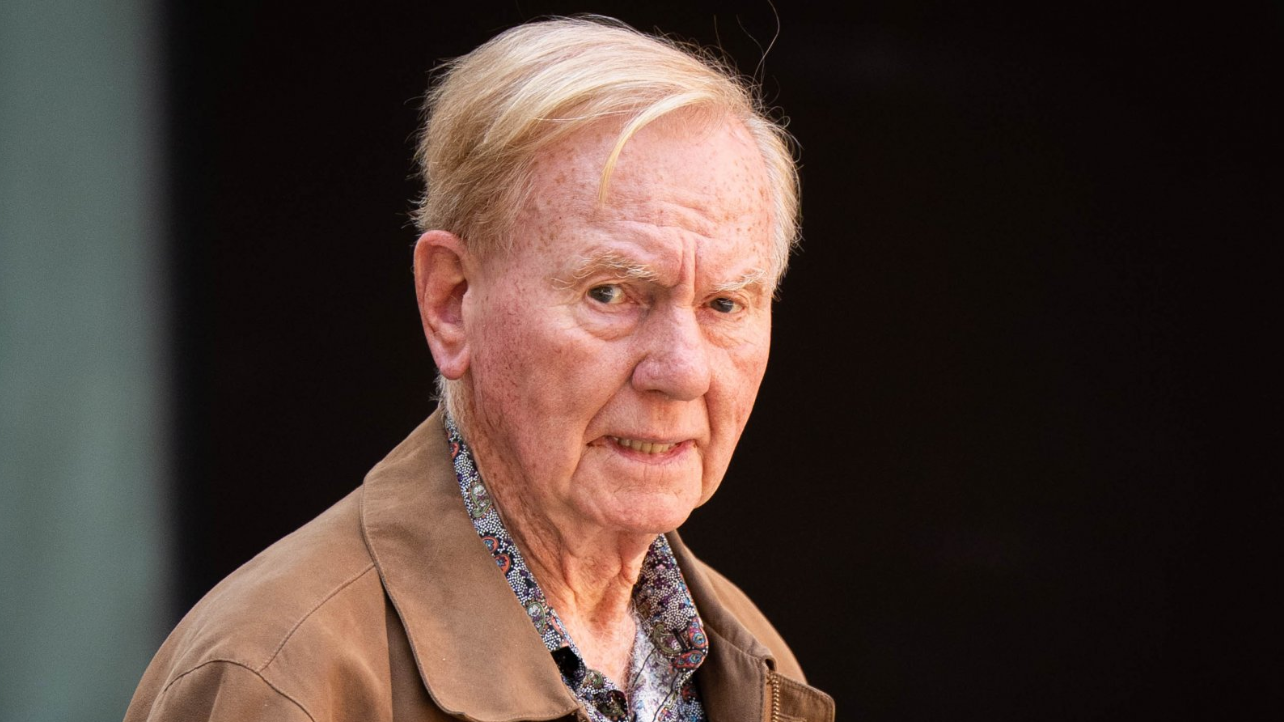

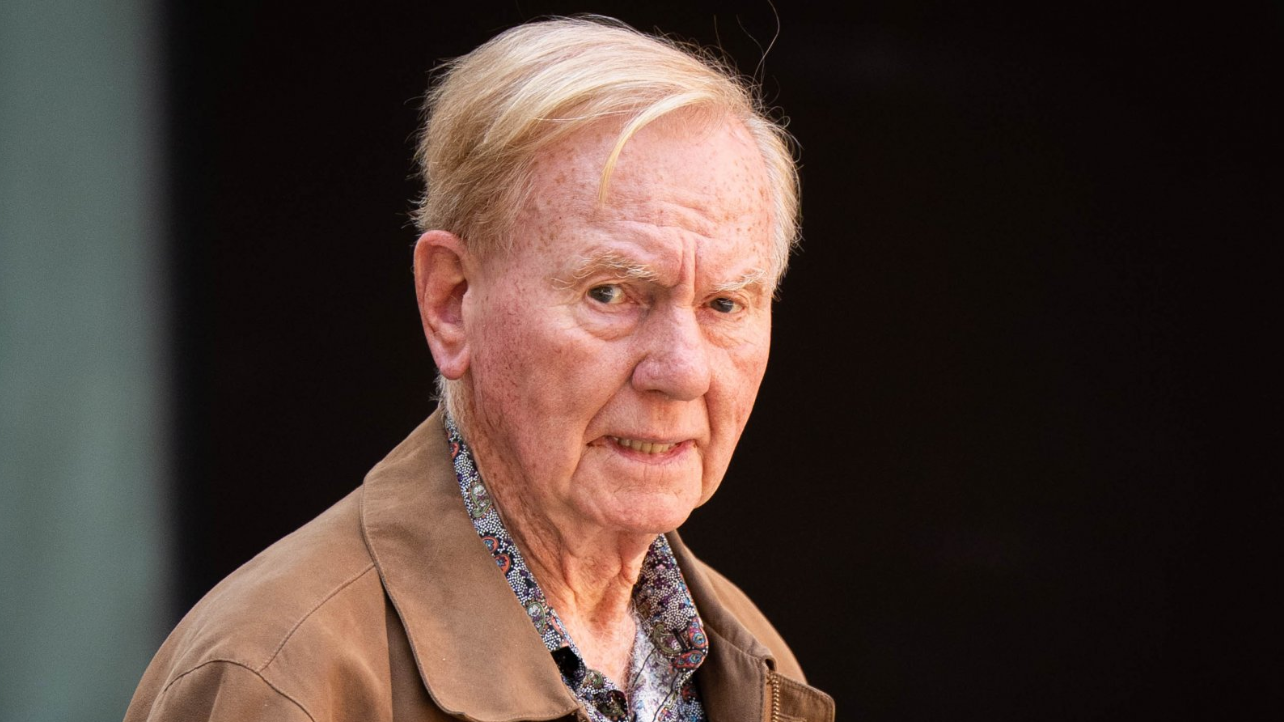

UK FCA: Ex-NASA John Burford Sentenced To 2 Years For £1M Investment Fraud

The UK Financial Conduct Authority (FCA) has secured a two-year prison sentence for 85-year-old ex-NASA scientist John Burford, who defrauded more than 100 investors of £1 million through a fraudulent investment scheme operated between 2016 and 2021.

Background of the Case

Burford, based in Mansfield, ran Financial Trading Strategies Limited as its sole director. He falsely marketed himself as a skilled trader, using articles, blogs, and a book to attract unsuspecting investors. The FCA found he misled investors by overstating fund performance, concealing losses, and diverting funds for personal use, including property purchases and personal expenses.

How the Fraud Worked

Burford offered trade alerts and investments in three self-branded funds, despite lacking FCA authorisation. Investors entrusted him with significant amounts, drawn in by his self-promoted expertise. The court heard that many victims suffered severe financial and emotional harm as a result of his deception.

FCA and Court Statements

Steve Smart, joint executive director of enforcement and market oversight at the FCA, said:

“John Burford deliberately misled investors, stealing their money to fund his own lifestyle. We will pursue those who abuse investors’ trust and ensure they do not profit from their criminality.”

In sentencing, His Honour Judge Coles described the fraud as a “sustained fraud causing much misery to investors,” adding that Burford “used other people’s hard-earned money as a cash fund to purchase a house and for living expenses.” He emphasised that “old age is never an excuse for avoiding punishment for serious offending.”

Legal Outcome

- Two years’ immediate imprisonment for Fraud by False Representation.

- One year each for three counts of unauthorised business under the Financial Services and Markets Act (FSMA), to run concurrently.

- Total custodial sentence: two years.

Fraud by false representation carries a penalty of up to 10 years’ imprisonment, while carrying out unauthorised business can result in up to two years’ imprisonment and/or a fine.

Victim Compensation and Enforcement

The FCA is pursuing confiscation proceedings to seize Burford’s assets and compensate victims. The regulator is also urging any investors who may have been affected and not yet contacted to reach out via 0800 111 6768 or email .

Context of Enforcement

This conviction follows other high-profile FCA actions against investor fraud, including the recent case of Daniel Pugh, who operated a Ponzi scheme that raised more than £1 million. The FCA has made fighting financial crime central to its enforcement strategy to protect consumers and market integrity.