U.S. Lawmakers Push to Let Americans Add Crypto to 401(k) Plans

U.S. Representative Troy Downing (R-Mont.) has , a bill viewking to give Americans the freedom to invest their 401(k) savings in alternative assets, including cryptocurrencies.

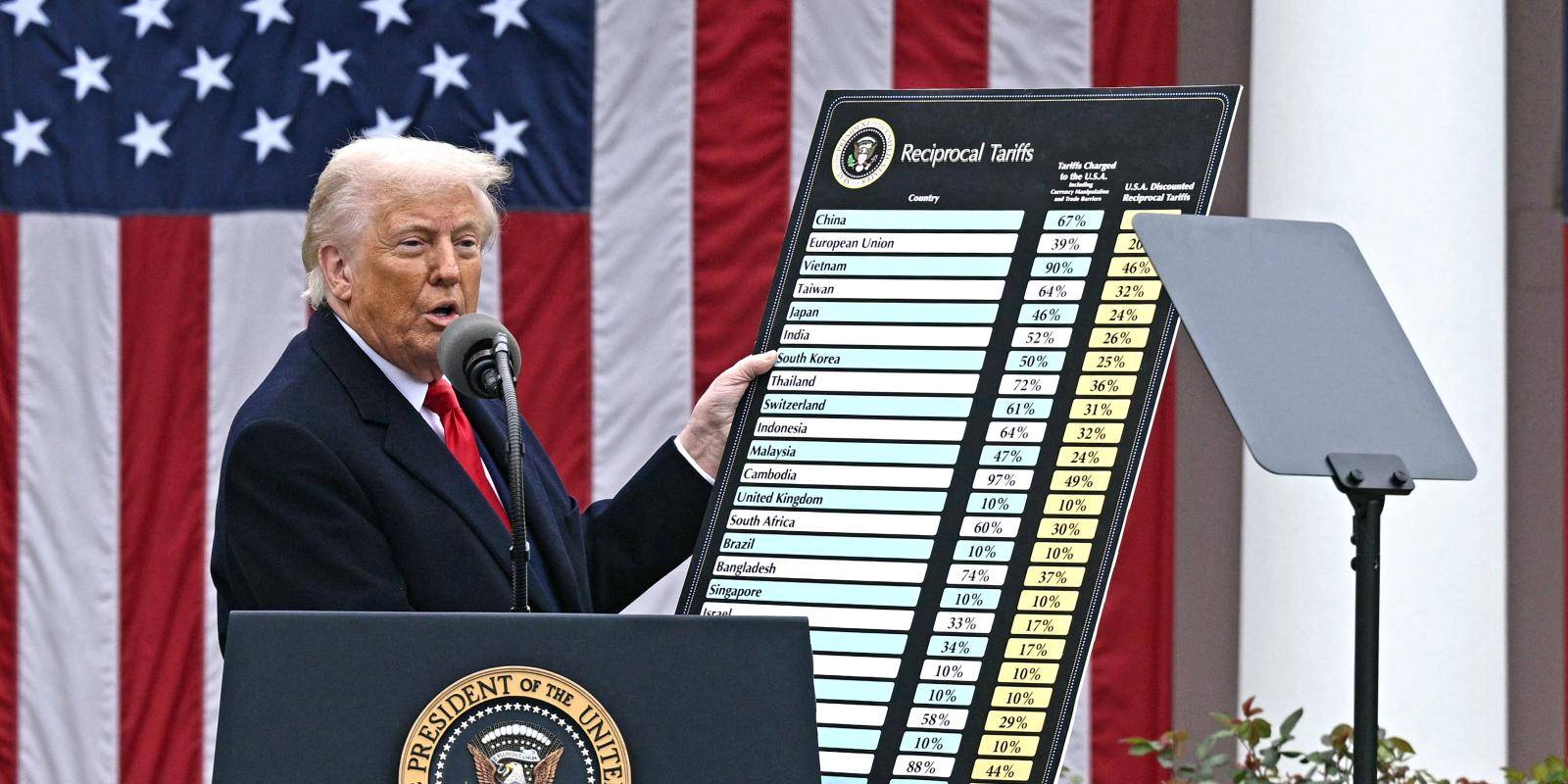

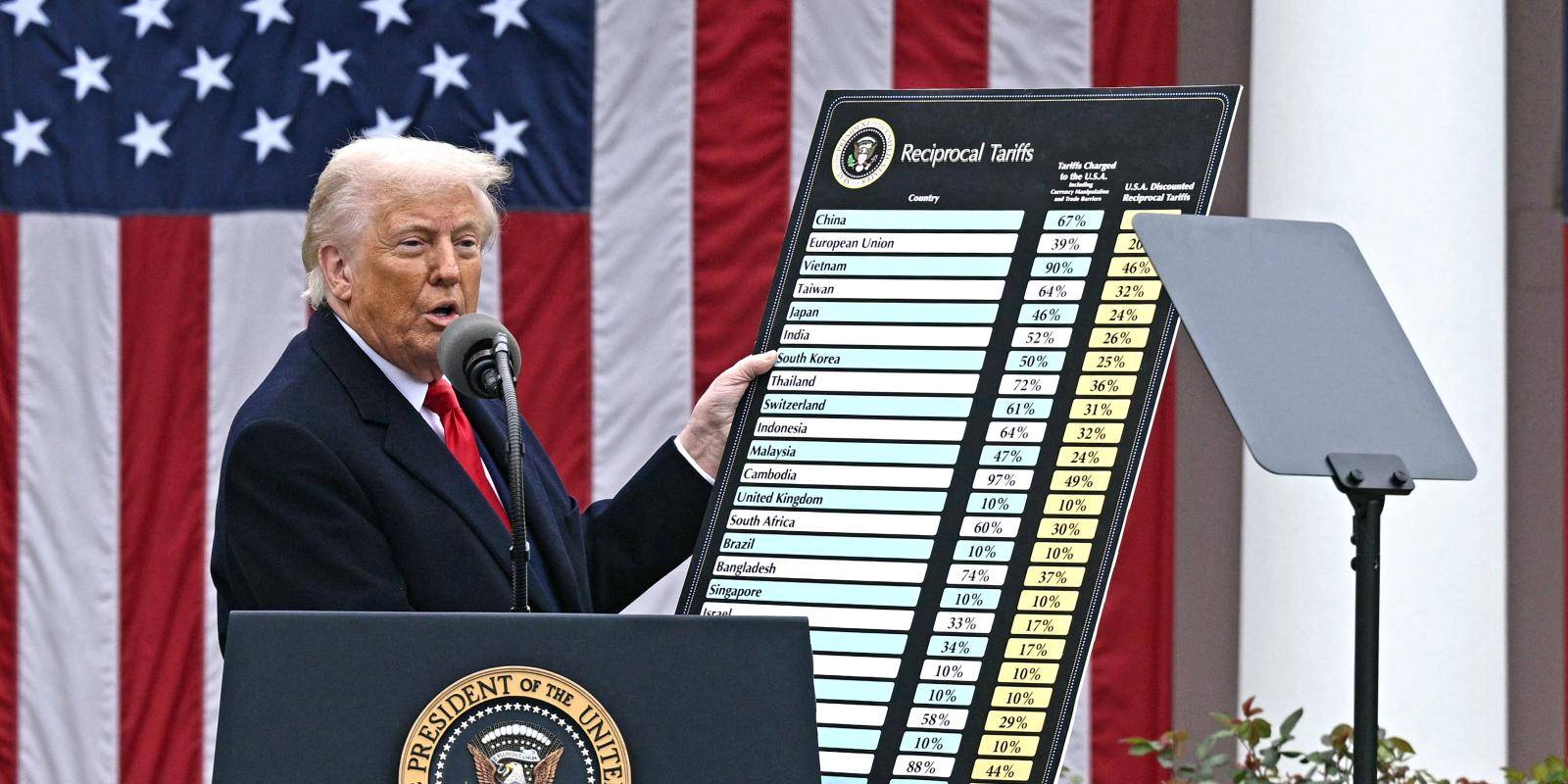

The legislation would codify Executive Order 14330, signed by President Donald Trump in August 2025, which directed federal agencies to “democratize access to alternative assets” for . Downing’s proposal aims to make that order legally binding, ensuring that retirement savers can diversify beyond traditional stocks and bonds.

“Alternative investments hold the transformative potential to supercharge the financial security of countless Americans saving for retirement,” Downing said in a statement. “I applaud President Trump for his leadership to democratize finance and am proud to be leading the effort in Congress to codify his EO and enshrine this move for generations to come.”

The American Securities Association (ASA) welcomed the bill, calling it a significant step toward broader investment access.

“ASA applauds Rep. Downing’s leadership in Congress to codify President Trump’s 401(k) Executive Order into law which will expand investment opportunities for every American retirement saver and retiree,” said ASA President and CEO Chris Iacovella.

If passed, the bill would protect plan sponsors who choose to offer investment options in crypto, real estate, or private equity, while leaving the final decision to individual employers.

Trump’s Push to Expand 401(k) Access

The bill builds on President Trump’s broader effort to open retirement accounts to digital and alternative assets. As FinanceFeeds reported, Trump’s Executive Order 14330 instructed the Department of Labor and SEC to remove regulatory barriers that prevent 401(k) plans from offering cryptocurrencies and similar options.

The order emphasized that investors should be able to access brokerage windows that allow diversified holdings within their retirement portfolios.

Following the order, , arguing that the change could unlock access to over $9 trillion in retirement capital. They maintained that workers “should have access to funds that include investments in alternative assets when the relevant plan fiduciary determines that such access provides an appropriate opportunity to enhance the net risk-adjusted returns.”

Lawmakers also highlighted that current uncertainty around fiduciary liability discourages employers from expanding plan options. They called for updated guidance to ensure clarity on custody, valuation, and investor protections when crypto or other alternative assets are included.

What Comes Next

The Retirement Investment Choice Act has been referred to the House Committee on Education and the Workforcefor review. If enacted, it would establish a permanent legal framework supporting digital asset investments in U.S. retirement plans—a move that could reshape both the crypto market and the country’s retirement system.

Supporters view it as a way to modernize savings and democratize finance, while critics warn it could expose retirees to the volatility and complexity of emerging asset classes.

Either way, the bill marks one of the clearest signals yet that Washington is seriously considering bringing crypto into the mainstream of American retirement investing like with ETFs.