Strategy Buys 1,955 BTC for $217 Million, BTC Yield YTD Hits 25.4%

What Happened: Largest BTC Treasury Expands

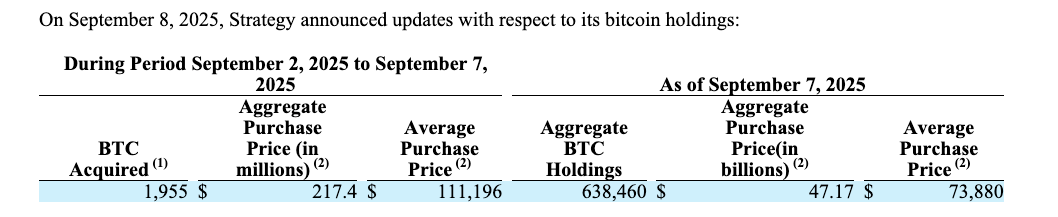

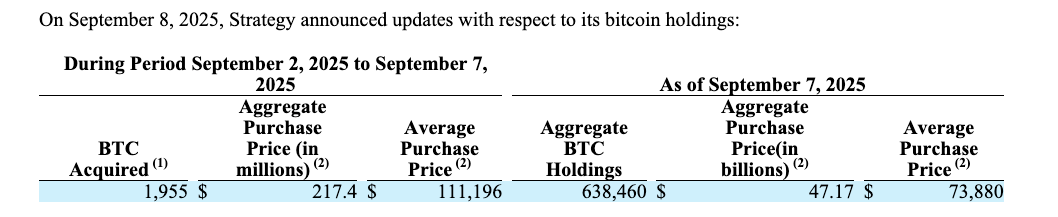

Strategy Inc. (NASDAQ:MSTR), led by Michael Saylor, the acquisition of an additional 1,955 BTC for approximately $217.4 million between September 2 and 7, 2025.

The purchase, disclosed in a , was executed at an average price of $111,196 per BTC and pushed the company’s total holdings to a staggering 638,460 BTC worth roughly $47.17 billion at press time and representing over 3% of the entire circulating BTC supply.

This latest purchase marks the eighth consecutive week of , underscoring Strategy’s aggressive treasury policy and further cementing its position as the largest publicly traded corporate holder of BTC worldwide. The entire purchase was funded through recent equity and share issuances, continuing the firm’s “BTC-first” capital allocation model.

Strategy Records $23 Billion in Unrealized Gains, 25.4% YTD BTC Yield

Strategy’s latest $217 million BTC purchase signals sustained institutional demand and confirms its commitment to BTC as a core treasury asset, especially relevant as traditional equity markets show increased volatility. The company’s reported , measured as the percentage change in the ratio between its BTC holdings and diluted shares outstanding, illustrates how its crypto accumulation is outperforming conventional benchmarks and boosting shareholder value.

This yield target was raised mid-year, outpacing prior projections and strengthening Saylor’s narrative of BTC as “digital transformation capital.” With over $23 billion in unrealized gains on its and continuing purchases despite recent exclusion from the S&P 500 (which favored Robinhood over Strategy), the firm is setting an industry precedent for crypto treasury management.

Investor Takeaway

How Does Strategy Compare to Competitors?

With 638,460 BTC, Strategy far outpaces every public competitor, including MARA Holdings (52,477 BTC), XXI (43,514 BTC), BTC Standard Treasury Company (30,021 BTC), and (20,136 BTC). Its average BTC acquisition cost remains $73,880, well below current prices.

By proactively using equity raises to fund continuous BTC acquisitions — even amidst share price declines (MSTR fell 26% since July) — the company continues to leverage its market position and capitalize on ongoing corporate adoption waves.

Strategy’s Executive Chairman, Saylor, also recently entered the ranking 491st globally with an estimated net worth of $7.37 billion. His fortune has risen nahead $1 billion this year—a 15.8% gain fueled by Strategy’s soaring stock and BTC holdings.

Over 200 public companies now hold BTC, signaling deepening institutional belief in the asset as a strategic capital reserve, though some critics warn of market concentration risks as large holders, like Strategy, control sizable portions of supply.

Investor Takeaway

What’s Next for Corporate BTC Adoption?

The latest purchase reflects Strategy’s modified guidance on share issuance. The company recently dropped its promise to refrain from new share sales if its mNAV ratio fell below 2.5X, raising the specter of future dilution for shareholders.

Nonetheless, with BTC yields outstripping equity returns and new competitors (such as Metaplanet in Japan) ramping up acquisitions, the race for treasury BTC is likely to escalate in coming quarters. Ambitious yield targets have been set as aims for a 30% year-end BTC yield and an additional $20 billion in paper gains.

For investors and traders, these moves signal a paradigm shift in how corporations are using digital assets to manage balance sheets. Yields, treasury management strategies, and large-scale crypto purchases will remain prime factors driving sector volatility and opportunity as adoption accelerates into 2026.