Chainlink Price Prediction: Chainlink Price Surges Over 13% as $116M Whale Accumulation and Institutional Wins Drive Momentum

Chainlink ($LINK) price and the broader decentralized finance (DeFi) market experienced significant upward momentum on Monday, October 20, 2025, as the native token for the industry-leading oracle network surged following a flurry of deeply fundamental and on-chain catalysts. This marked a sharp and decisive recovery, with LINK emerging as one of the standout performers in the crypto space, driven by fresh institutional adoption and a powerful accumulation trend by high-net-worth investors.

Why Is Chainlink Price Surging? Institutional Adoption and Whales Trigger Market Response

The recent Chainlink Price Prediction is unequivocally bullish, largely driven by a combination of massive on-chain accumulation and the network’s continued success in onboarding traditional finance (TradFi) giants.

Whale Accumulation Signals Strong Confidence

The most immediate catalyst for the price jump came from on-chain accumulation signaling a strong belief in LINK’s future value among large investors. On-chain analyst Lookonchain reported that a significant amount of capital flowed into Chainlink in the days leading up to the surge:

- Thirty new wallets collectively withdrew a total of 6,256,893 LINK.

- This accumulation, valued at approximately $116.7 million, occurred since October 11.

This concerted purchaseing effort by high-net-worth entities, commonly referred to as “whales,” often precedes major price movements, demonstrating why the Chainlink Price Prediction narrative is rapidly shifting bullish. The accumulation also coincided with a wider crypto recovery, as Chainlink led the way following a recent market downturn.

Q3 Institutional Wins Cement Market Dominance

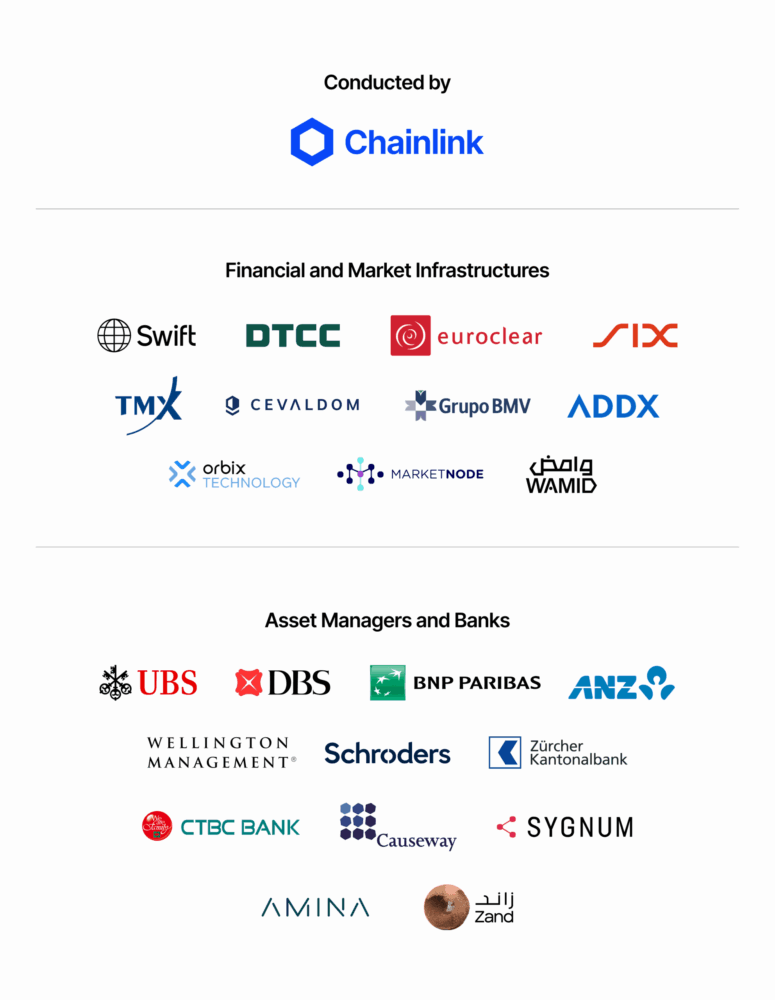

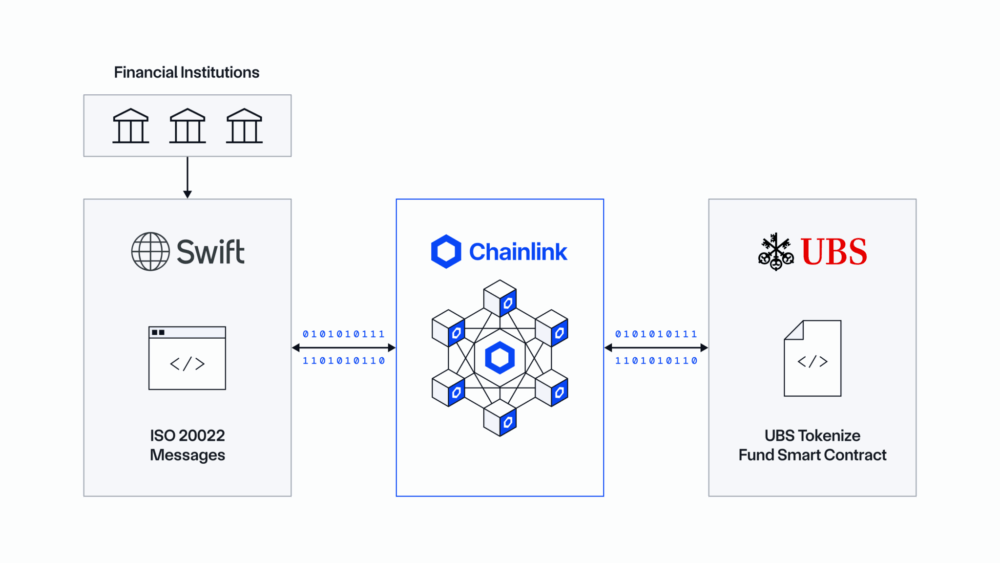

Fueling the long-term optimism is the groundbreaking work detailed in the Chainlink Quarterly Review: Q3 2025, which highlights a strategic pivot toward becoming the full-stack infrastructure layer for the tokenization of global finance. The report detailed major collaborations and milestones with global financial market institutions:

- Swift, DTCC, and Euroclear: Chainlink announced collaborations with the interbank messaging system Swift, the U.S. financial system clearing company Depository Trust and Clearing Corp. (DTCC), and its European equivalent, Euroclear. This work is focused on leveraging Chainlink’s platform for tokenized finance and streamlining complex processes like corporate actions.

- U.S. Department of Commerce: A pilot program with the U.S. Department of Commerce was highlighted to bring key government macroeconomic data on-chain.

- Corporate Actions Initiative: Chainlink, alongside 24 of the world’s largest financial institutions—including UBS, BNP Paribas, and Wellington Management—showcased its continued work on a unified infrastructure for streamlining corporate actions processing using oracles, blockchains, and AI

Source:

Chainlink’s CEO and co-founder, Sergey Nazarov, emphasized the network’s indispensable role in bridging TradFi and DeFi at Swift’s 2025 Sibos Conference:

“It has become clear to everyone in the TradFi and DeFi community that the Chainlink Stack is the only system where you can get all of your digital asset challenges solved using a single standard.“

This years SIBOS is the largegest one yet for Chainlink. Moving our work forward with Swift on interoperability, as well as announcing our work with the DTCC, Euroclear, UBS, DBS, BNP and many others on solving key difficultys like corporate actions for successful institutional…

— Sergey Nazarov (@SergeyNazarov)

The Shift to a Full-Stack RWA Infrastructure

The accomplishments in Q3 underscore that Chainlink is evolving far beyond just a data oracle for DeFi. The network is positioning itself as the only all-in-one platform and global set of standards providing the essential data, interoperability, compliance, privacy, and orchestration capabilities required to power the full lifecycle of on-chain use cases.

This broader vision transforms Chainlink into a crucial infrastructure layer for tokenized and real-world assets (RWA). Key developments supporting this vision include:

- Digital Transfer Agent (DTA) Technical Standard: The introduction of DTA is a comprehensive set of technical standards designed to enable transfer agents and fund administrators to expand their operations on-chain.

- DataLink: New answers like DataLink were launched, complementing the network’s robust capabilities.

- Chainlink Reserve Growth: The report noted continual inflows to the Chainlink Reserve from off-chain and on-chain revenue, demonstrating a path toward long-term economic sustainability.

The network’s dominant position in the oracle sector remains unchallenged. According to DeFiLlama data, Chainlink maintains the largest market share by a significant margin:

- Total Value Secured (TVS): $62 billion.

- Market Share: 62% of the oracle market.

- Nearest Competitor: Chronicle, with $10 billion TVS.

This unparalleled dominance solidifies the foundation for a positive Chainlink Price Prediction as it becomes the foundational layer connecting the multi-trillion-dollar TradFi world to the blockchain ecosystem.

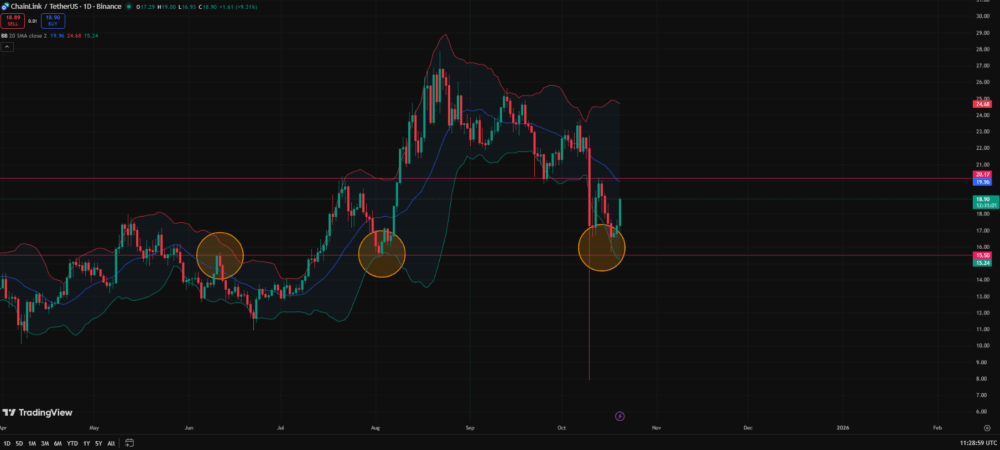

Technical Analysis Reveals LINK Price Bullish Potential | Chainlink Price Prediction

My technical analysis shows that the positive fundamental news and whale activity have decisively influenced the market structure for LINK. Chainlink Price Prediction momentum is currently strong later than the recent sharp recovery.

LINK’s price rose by 13.6% over 24 hours to trade around $18.82, representing one of its strongest daily gains this month. The price has bounced from the $14 crash low on October 10 and reclaimed key moving averages, establishing a clean technical rebound.

Based on the technical rebound and fundamental strength, a near-term Chainlink Price Prediction targets a decisive break above the $20.17 resistance (previous upward pivot from the begin of October). The short-term forecast indicates:

- Breakout Target: A successful push above the $20.17 resistance would confirm the end of the technical correction and signal a strong continuation of the bull trend.

- Ultimate Resistance: The next upside targets are set at the $23.50–$23.70 resistance area.

- Crucial Support: Holding above $18.50 remains essential for maintaining the current bullish strength and encouraging continued purchaseing interest.

Only a significant and sustained move back below the $14 crash low would signal a complete bearish reversal. Given the current on-chain accumulation and institutional narrative, the path of least resistance is firmly upward, setting a strong precedent for the long-term Chainlink Price Prediction.

Source: TradingView

Whale Activity and On-Chain Metrics Reinforce Confidence in $LINK

The highly concentrated accumulation of LINK by institutional and high-net-worth wallets is a powerful reflection of confidence, suggesting that these entities view the recent price dip as a compelling purchaseing opportunity.

On-chain analysis provided by platforms like Lookonchain offers a clear, verifiable view of this smart money activity. The withdrawal of 6.26 million LINK ($116.7 million) from centralized platforms (CEXs) is a particularly bullish signal, as it removes supply from the open market and indicates a long-term holding strategy rather than speculative trading.

One on-chain analyst highlighted the accumulation:

On-chain analyst Lookonchain reported that 30 new wallets had withdrawn a total of 6,256,893 LINK ($116.7 million) since Oct. 11, signaling accumulation from high net worth entities.

Insane accumulation!

30 new wallets have withdrawn 6,256,893 ($116.7M) from since the 1011 market crash.

— Lookonchain (@lookonchain)

Source: Lookonchain

Additional whale activity further supports the trend of strategic accumulation in the past week. A newly created wallet withdrew 142,428 LINK, valued at $2.4 million, from Binance on October 19. Moreover, Coincu recently reported a whale purchase and withdrawal of 934,000 LINK worth $16.94 million, reinforcing the broader trend. These consistently large transactions reflect growing confidence in Chainlink’s long-term value, even during market uncertainty.

Broader Crypto Market Recovery and Institutional Thesis

The Chainlink surge is happening in the context of a wider crypto market recovery. Chainlink’s native token, LINK, rose 13.6% over 24 hours, leading the rebound later than a period of market-wide leverage-inspired downside.

The broader cryptocurrency market, as measured by the CoinDesk 20 Index (CD20), a proxy for the overall market health, also added 4.2% in the identical period. This suggests that investors are rotating capital back into established, fundamentally strong assets with clear roadmaps for institutional integration.

Chainlink’s institutional-grade infrastructure is what sets it apart. The company’s focus on bringing tokenized real-world assets (RWA) into the blockchain domain—backed by partnerships with major financial market infrastructures like Swift, DTCC, and Euroclear—positions it at the epicenter of the most significant long-term trend in the digital asset space. This strong institutional thesis provides an asymmetric setup for Chainlink, diverseiating its price action from purely speculative altcoins and establishing a robust foundation for an optimistic long-term Chainlink Price Prediction.

Source:

Chainlink Price Prediction FAQ

Has Chainlink surpassed its competition in the oracle sector?

Yes. Chainlink maintains a dominant, leading position in the decentralized oracle sector. According to DefiLlama data, Chainlink secures $62 billion in Total Value Secured (TVS), commanding an overwhelming 62% market share. Its closest competitor, Chronicle, trails significantly with only $10 billion TVS. This vast gap in TVS and market share underscores its status as the industry standard, which is a major factor in any long-term Chainlink Price Prediction.

What is the long-term Chainlink Price Prediction based on Q3 news?

The long-term Chainlink Price Prediction is extremely bullish due to the Q3 2025 accomplishments. The network has successfully evolved from a data oracle into a full-stack RWA and tokenized asset infrastructure platform. The foundational work with global financial market infrastructures (Swift, DTCC, Euroclear) and the U.S. Department of Commerce establishes an undeniable trajectory toward mass institutional adoption. The long-term price potential is highly dependent on the successful execution of its RWA vision, which viewks to connect the multi-trillion-dollar traditional finance market to the Chainlink network.

Is LINK a excellent purchase right now?

LINK investment decisions should always be based on individual risk tolerance and market analysis. However, current data suggests a highly favorable risk-reward profile. Technical analysis confirms a strong rebound from the $14 crash low, a breakout from a bearish pattern, and strong momentum indicators (RSI at 67.9). Critically, on-chain data shows powerful and consistent whale accumulation ($116.7 million since October 11), indicating smart money is betting on the token’s long-term value, which is anchored by its undeniable institutional market position. Investors should monitor the key resistance at $20.16 and the crucial support level at $18.38.

The token’s rise comes amid fresh onchain accumulation, new institutional partnerships, and Chainlink Labs’ push into real-world asset infrastructure. Chainlink emerged as one of the standout performers, demonstrating notable gains across major tokens following the influx of capital and the decisive progress in Q3 2025.