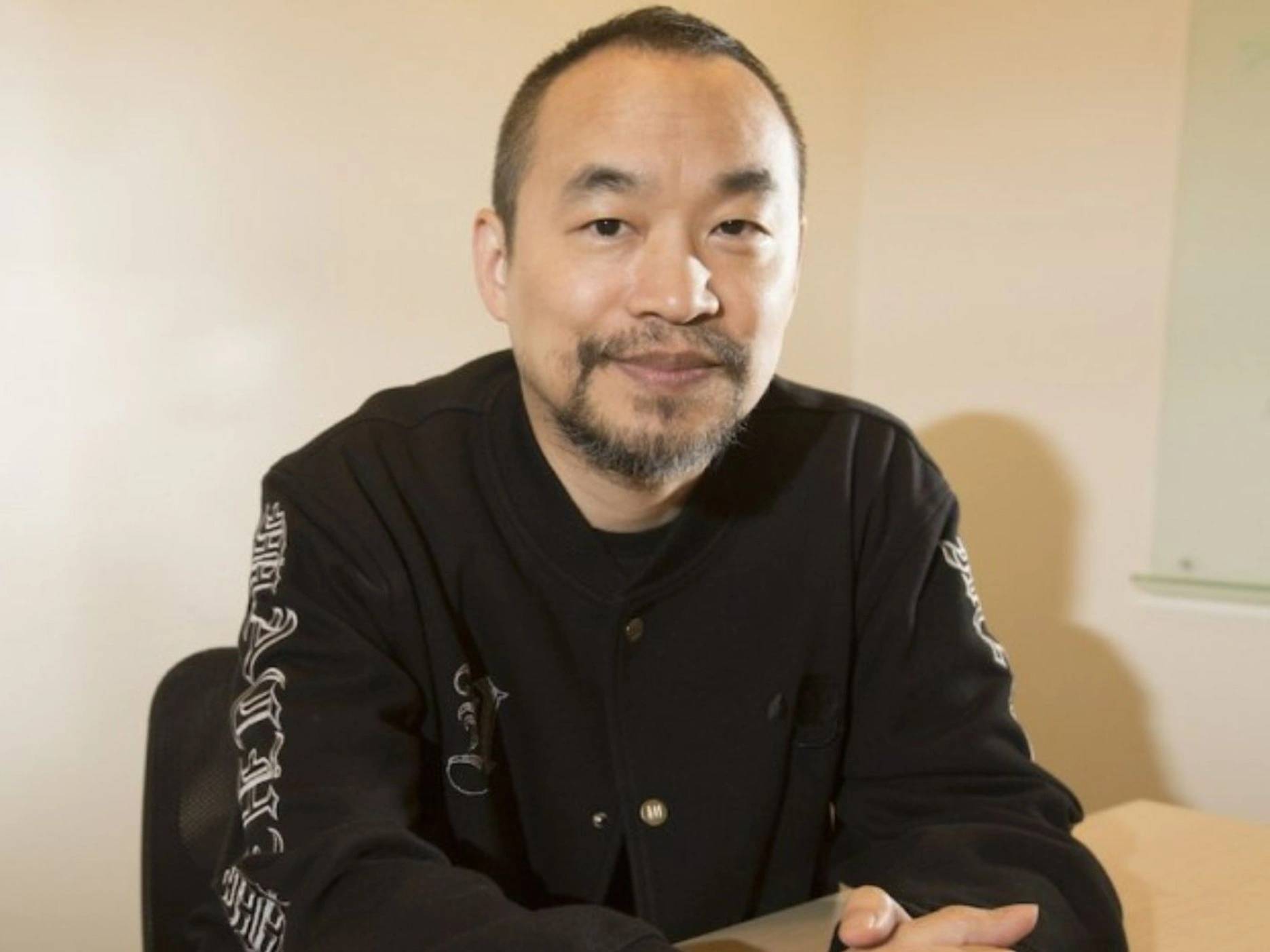

Machi large Brother Risks Millions in Potential ETH Liquidations

Jeffrey Huang, better known in the crypto world as Machi large Brother, could lose millions of dollars as ETH’s price declines, putting his long bets at risk. Huang, a well-known whale and investor, has been actively increasing his ETH exposure through the perpetual trading platform Hyperliquid, even if the market is begining to turn bearish.

Increasing High-Leverage Bets During a Downturn

say that Huang has over 2,575 ETH, worth more than $10 million, and can use up to 25 times that amount. and Bitget track on-chain data that shows his position will be closed if ETH drops below about $3,803. ETH’s price has been under increasing pressure over the past week. It fell by around 4% over 24 hours, putting Huang’s margin account at risk.

Even though the market has gone down, Huang has kept adding collateral. Earlier this week, he said he would add an extra $100,000 and 220,000 USDC to delay liquidation. His aggressive strategy shows he believes in ETH’s long-term strength, but it also makes him more vulnerable if the market keeps falling.

From ahead Gains to Growing Pressure

Machi large Brother was one of best traders just a few weeks ago, with total earnings exceeding $43 million. But a string of high-leverage trades and liquidations that happened one later than the other have completely changed his luck.

Recent transaction logs show that his positions have lost tens of thousands of dollars, and some ETH positions were forced to close when the market fell below $3,900.

Analysts he lost money because he borrowed too much when the market was more volatile. ETH, which temporarily rose to $4,077 earlier this week, immediately plummeted back below key support levels, increasing the risk of liquidation across many accounts.

How The Community Reacted and What It Means For The Market

The larger crypto community has strongly condemned Huang’s hazardous bets, using his case as a clear example of the volatility of trading with high leverage. Traders can handle enormous positions with little collateral on platforms like Hyperliquid. This gives them a lot of upside potential, but it also means they are at significant risk when the market turns.

Whale activity like Huang’s can make market fluctuations worse. When leveraged positions are forced to trade, cascading trade-offs can push prices even lower, making the market even scarier.

Analysts say that if keeps falling, liquidation cascades could spread to other assets, putting even more downward pressure on the broader crypto ecosystem.

A Dangerous Place

Machi large Brother’s margin ratio remains dangerously high, close to critical levels that could trigger immediate liquidation if the price of ETH drops further.

Huang is still known as a daring trader, but his recent losses show how risky can be, where a few percentage points can make the difference between huge gains and huge losses.