Pepecoin (PEPE) Price Prediction: Meme Coin Retreats, New DeFi Crypto Offers More Potential

The meme coin rally that once dominated social media is showing clear signs of fatigue. Pepe (PEPE), one of the most viral tokens of 2024, has viewn price momentum cool off amid tightening resistance and investor rotation into more utility-driven projects. While PEPE still boasts massive visibility, its market structure now limits large upside moves. In contrast, a new entrant, , is attracting increasing attention for combining real utility with ahead-stage pricing. As Q4 2025 unfolds, the contrast between hype top crypto tokens and function-based DeFi projects is becoming hard to ignore.

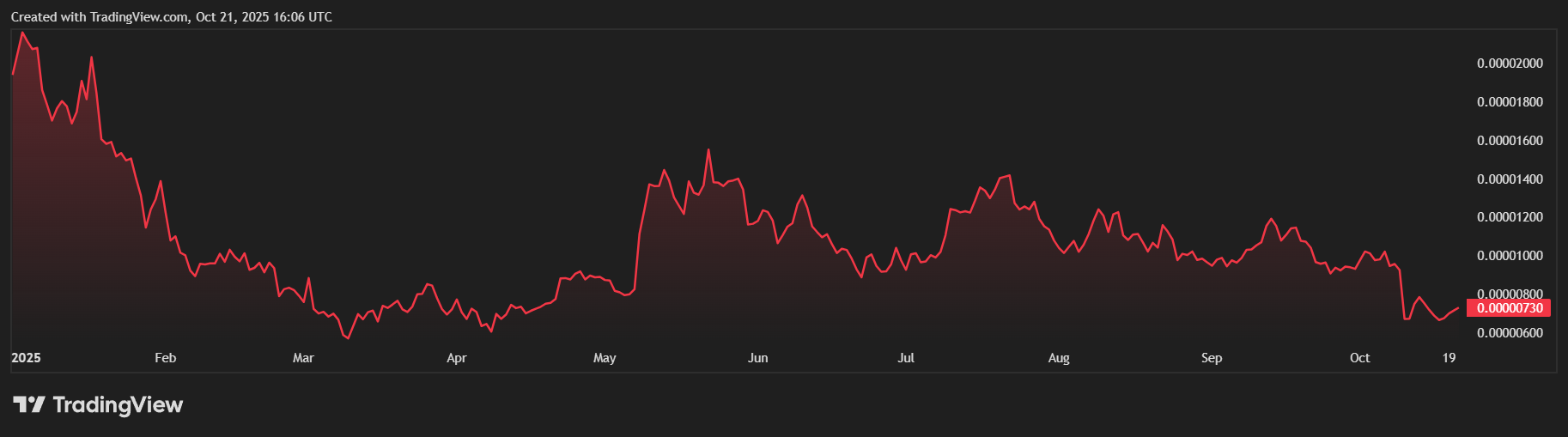

Pepe (PEPE) Price Overview

At the time of writing, Pepe (PEPE) trades near $0.0000091, reflecting a market cap of roughly $3.8 billion with a circulating supply hovering around 420 trillion tokens. This scale once powered its viral rise, but it also makes further exponential gains hard to sustain.

Technical data shows support around $0.0000092–$0.0000097, while immediate resistance appears between $0.0000107 and $0.0000110. Bulls face heavier resistance near $0.0000130–$0.0000145, a zone that has rejected multiple breakout attempts in recent weeks.

Short-term analysts describe PEPE’s structure as range-bound and liquidity-dependent. Without new catalysts or ecosystem developments, the token risks stalling below these resistance bands.

Traders watching the charts note that the asset’s massive float makes large percentage swings harder, especially now that speculative inflows have rotated toward smaller, utility-based projects.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is rapidly gaining momentum in its presale phase, attracting growing attention from both retail and institutional investors. The current price is $0.035 in Phase 6, which is already over 71% allocated. So far, the project has raised $17.73 million from more than 17,350 holders, signaling strong participation and confidence in its roadmap.

The presale uses a fixed-price, fixed-allocation model, once a phase trades out, the price automatically increases. later than Phase 6 closes, the token will advance to $0.04, with launch price set at $0.06, marking a clear step-based appreciation for ahead participants.

At its core, Mutuum Finance (MUTM) is building an ETH-based lending and borrowing protocol that combines Peer-to-Contract (P2C) liquidity pools for major assets like ETH and stablecoins with a Peer-to-Peer (P2P) marketplace for customizable, isolated deals. Borrow rates adjust dynamically based on utilization, lower when liquidity is plentiful, higher when demand tightens, ensuring smooth capital flow.

On the token-economy side, Mutuum Finance is designing a model where a portion of protocol fees and platform revenue will be used to purchase MUTM on the open market; MUTM purchased on the open market will be redistributed to users who stake mtTokens in the securety module. This planned mechanism links platform activity to token demand, offering value growth potential beyond short-term speculation.

Why Analysts Favor MUTM Over PEPE

Analysts tracking DeFi presales have made one point clear: PEPE’s upside potential is limited by scale and substance, while MUTM’s growth path is still open.

Pepe’s limitations are structural. With a $3.8 billion market cap and a supply in the hundreds of trillions, percentage gains now require enormous capital inflows. The coin also lacks functional utility, it does not generate yield, drive lending, or anchor any on-chain activity. As a result, its price relies almost entirely on market hype and speculative demand. In calmer market conditions, that narrative loses strength rapidly.

By contrast, Mutuum Finance (MUTM) is ahead in its curve, priced at just $0.035, it carries a market cap far smaller than most established DeFi tokens, leaving ample room for appreciation. Its fundamentals also support long-term valuation: utilization-based lending, risk-managed borrowing, and token utility tied to platform revenue.

The project’s confirms that V1 of its protocol is set to launch on Sepolia testnet in Q4 2025, including a Liquidity Pool, mtToken, Debt Token, and Liquidator Bot, with ETH and USDT as the initial assets.

This development milestone, along with an eventual mainnet rollout, creates a credible product roadmap, something meme tokens like PEPE simply do not have. Analysts comparing the two note that ahead-stage MUTM holders could view multiple expansion as the protocol begins generating lending volume, whereas PEPE’s chart suggests range-bound behavior for the foreviewable future.

Long-Term Catalysts and Presale Urgency

Mutuum Finance’s roadmap doesn’t stop at lending. Upcoming features include an overcollateralized stablecoin designed to improve borrowing predictability and liquidity depth, and Layer-2 expansion, which will reduce gas costs and boost throughput as transaction volumes rise. Together, these milestones could significantly expand the project’s user base and, by extension, demand for MUTM tokens over time.

Meanwhile, Phase 6 of the presale is tradeing out rapidly, with several large whale contributions exceeding 6 figures allocations in recent days. These inflows not only accelerate the transition to Phase 7 at $0.04 but also reflect growing confidence in Mutuum Finance’s fundamentals. For ahead investors, this stage is crucial, entry before the next price step provides a cost advantage.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:

Linktree:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.