Cardano Update: ADA Price Strengthens As Developers Roll Out Major Network Upgrade, Could $2 Be On The Horizon?

Cardano drew fresh attention today as developers shipped another round of scaling work and the ADA price steadied later than last week’s wobble. Traders are asking a simple question that matters for the next rounds of expected growth: does this upgrade cycle finally set Cardano on a credible path toward $2 if liquidity returns.

A smaller also caught smart money’s eye this week, adding a real-world twist to the “best crypto to purchase now” chatter without stealing the spotlight.

Cardano’s Upgrade Week: Hydra Work Continues, $2 Needs Validation

Cardano developers advanced Hydra items, including quicker chain following and improved deposit flows, while documentation updates kept contributors moving. The work builds on January’s governance hard fork, which activated the full DRep feature set and kept Cardano’s roadmap pointed toward scale, security, and resilience.

ADA traded around $0.63 to $0.64 today later than a soft stretch. Bulls want a decisive reclaim of $0.70 to $0.75 with rising volume to put $1 in view and turn the $2 debate from hope into scenario planning. Lose $0.60 on fragile breadth, and Cardano likely retests deeper support before any fresh attempt.

Why $2 Is Plausible, Not Promised

The bull case for Cardano leans on continued Hydra and Mithril efficiency gains plus research toward Ouroboros Leios. A healthier on-chain app cycle, stronger staking participation, and better liquidity would amplify those gains.

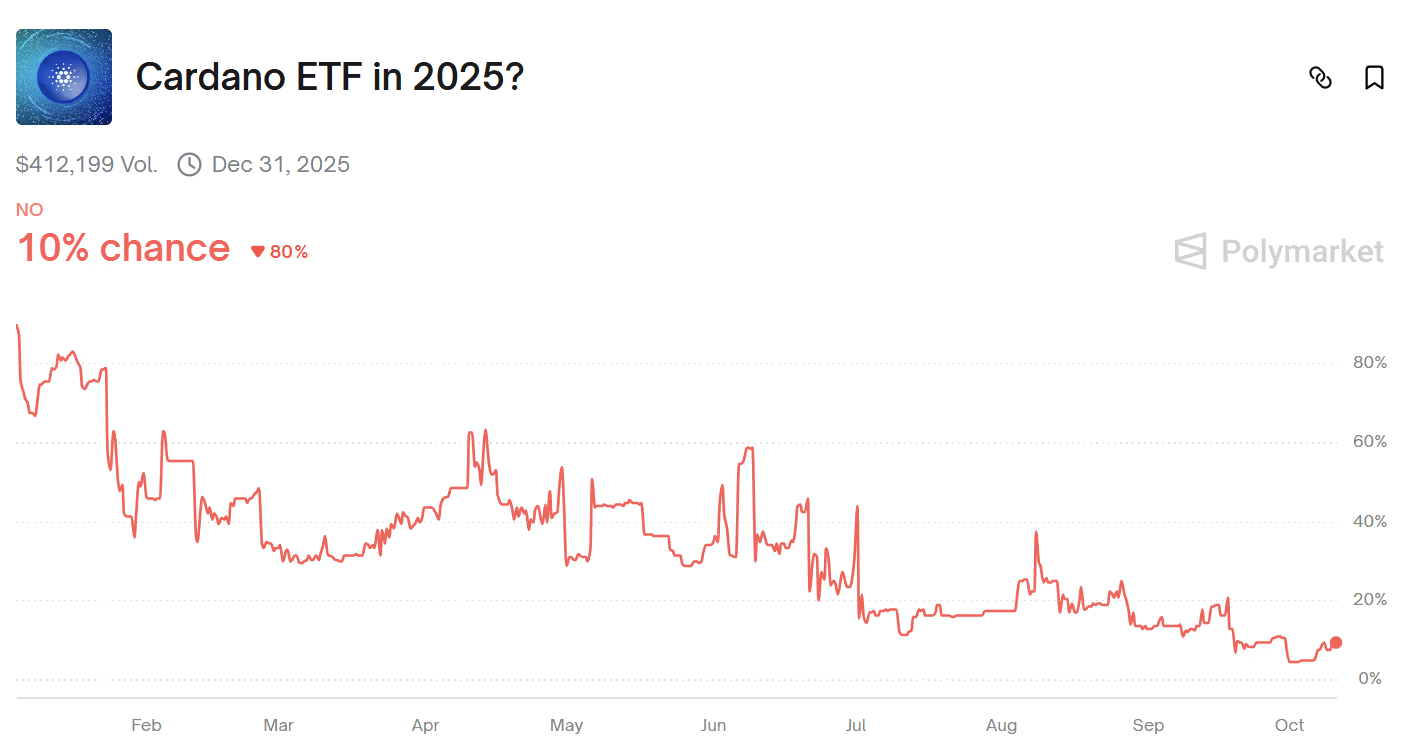

The bear case is macro. October flows cooled, regulatory headlines stayed noisy, and risk appetite faded. Cardano can still grind higher, but sustained breakouts usually require either broad ETF-led demand or a visible spike in Cardano adoption that proves the scaling story in practice.

Spot crypto ETFs posted record weekly inflows earlier , then momentum stalled as global risk sentiment slipped. For Cardano, calmer flows mean breakouts may need a catalyst, from either network usage or a new leg of ETF demand. In the meantime, investors are rotating toward clear roadmaps, low-gas-fee crypto narratives, and DeFi project ecosystems that already show product traction.

Remittix (RTX): The Payments Play Analysts Keep Flagging

, a PayFi ERC-20 coin in active wallet testing has become a frequent mention in “next large altcoin in 2025” threads. The project focuses on crypto-to-bank transfers and positions itself as a utility gateway while Cardano advances research-driven scaling.

Independent security is a major tick: the team is fully verified by CertiK, and it is ranked number 1 on CertiK for pre-launch tokens, which sharpens the credibility angle for cautious capital. Community beta testing is live, giving investors something concrete to evaluate beyond slogans.

You can currently purchase RTX tokens for $0.1166. The project reports that more than 30,000 investors have come in during recent months, and the price is scheduled to increase again. Access, product, and listings on centralized platforms form the near-term catalyst stack. The pitch is simple and sales-focused: limited time at current levels, visible product progress, and security stamped by the top auditor.

Cardano At A Turning Point

Cardano did the right things this week. Code shipped, ADA held key supports, and a clean reclaim of the mid $0.70s would upgrade the path toward $1 and keep $2 on the table. For portfolio builders, Cardano remains a core network bet.

Adding a small allocation to a payments-centric DeFi project like RTX can complement that core, blending Cardano’s long-cycle research path with near-term products and listing catalysts that investors often reward first.

Discover the future of PayFi with Remittix by checking out their project here:

Website:

Socials:

$250,000 Giveaway:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.