Your Bourse Empowers Brokers with Advanced Risk and Exposure Management Tools

In an industry where milliseconds define brokers’ profitability, Your Bourse stands at the core of trading technology.

Trusted by top-tier brokers and liquidity providers, Your Bourse delivers the infrastructure that powers real-time risk management and low-latency execution with .

As trading volumes and client sophistication grow, exposure management has become one of the defining challenges for any broker. Many brokers still rely on rigid CRM systems that treat every client the identical — regardless of trading strategy or risk profile.

The result is often missed hedging opportunities and increased exposure that can erode profitability.

Your Bourse addresses this challenge through intelligent automation and full transparency of order flow.

Brokers gain control and flexibility with:

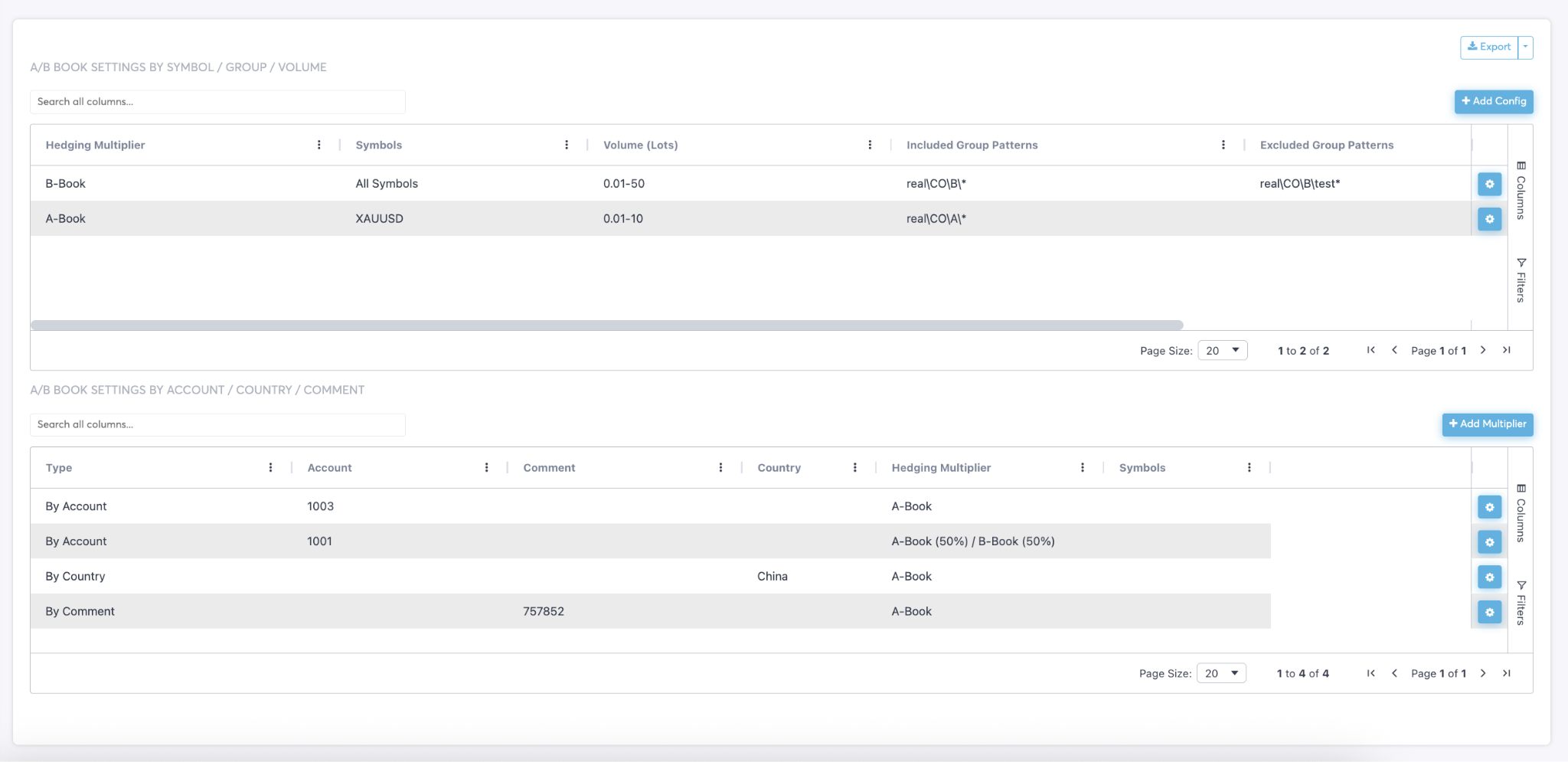

1. Flexible order routing

— define hedging rules by country, trade size, client group, symbol, or even specific EA accounts.

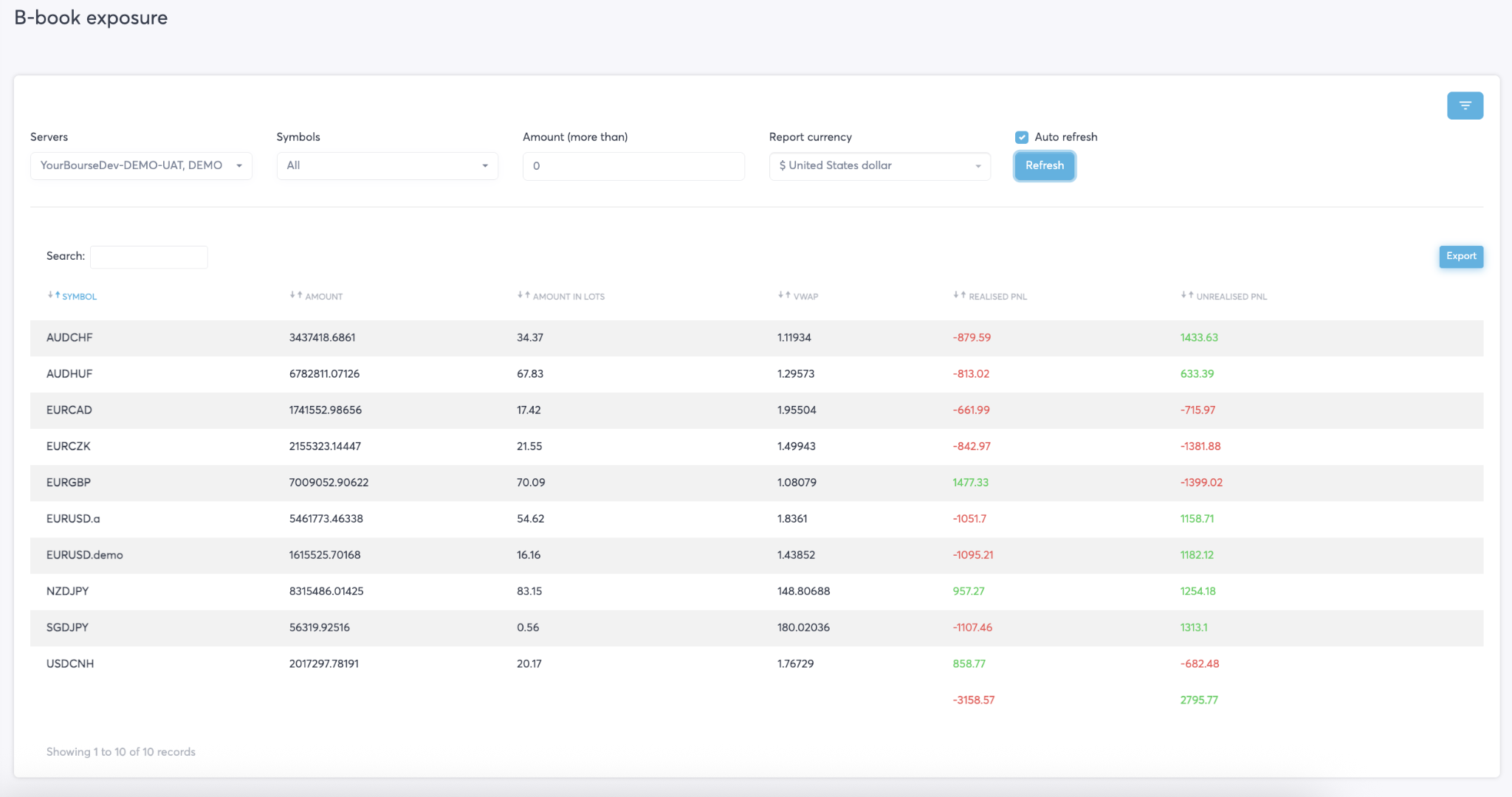

2. A/B-book exposure monitoring

— gain a real-time overview of your risk portfolio and performance.

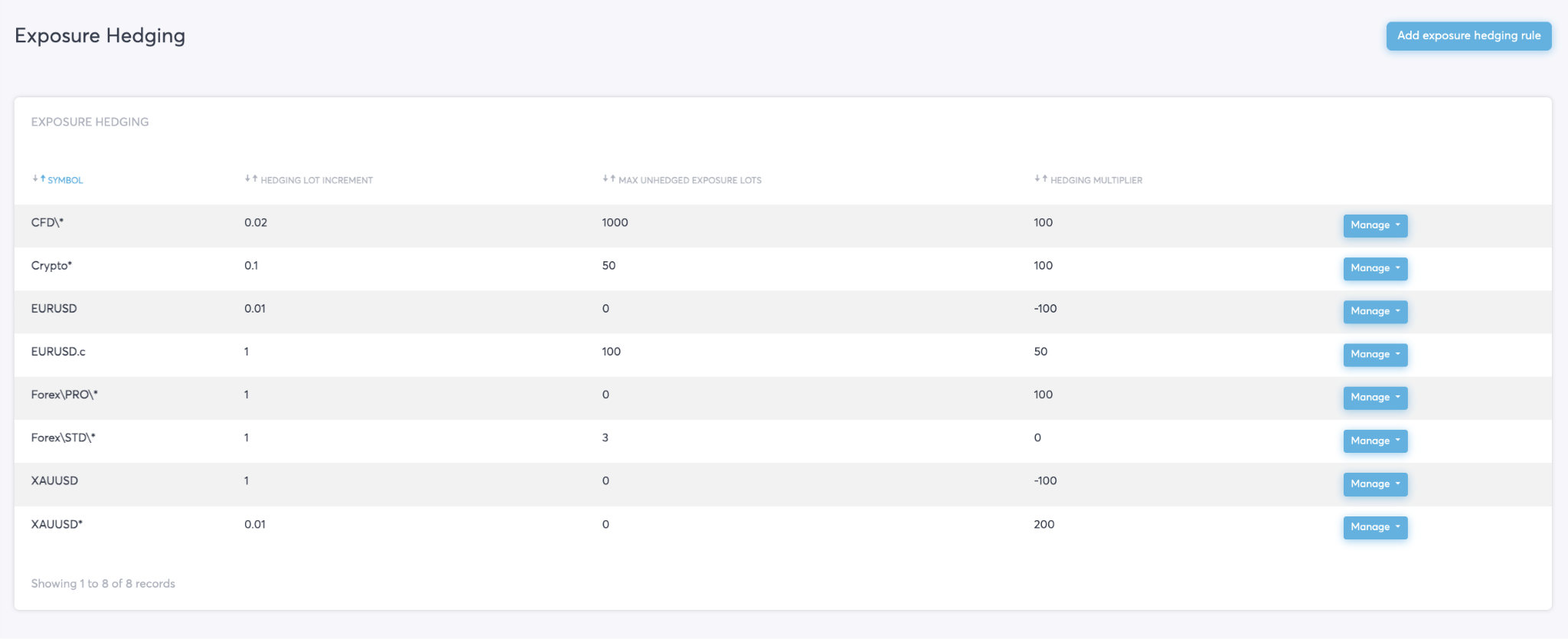

3. Exposure-based hedging

— automatically manage internal exposure before it reaches critical levels.

These answers enable brokers to manage toxic flow more effectively, maintain real-time visibility into risk, and keep hedging strategies efficient — ensuring stronger margins and operational resilience.

“During our collaboration, has consistently demonstrated exceptional professionalism, reliability, and deep expertise in FX/CFD technology. Their answers have enabled us to enhance execution quality, reduce technology costs, and centralize risk management and reporting workflows.”

— Nick Cooke, Founder and Group CEO at Taurex

Your Bourse continues to equip brokers with the technology and expertise required to optimise and execution quality across all asset classes — reinforcing its position as a trusted partner for institutions looking to achieve precision, performance, and profitability.