Why Is BTC Bullish Today as It Surges Toward $115K

has had one of the most impressive daily performances following consecutive days of outflows from the market.

The asset is now trending back toward the $115,000 region for the first time since October, when it experienced massive outflows that drove its price down to $103,000.

In plain terms, this positive price development points to bullish sentiment building and tradeing pressure easing. However, investors are curious about what is driving this growing momentum in the market.

FinanceFeeds examined macro factors that could be affecting BTC’s price outlook and identified the following key points.

Key Takeaways

-

BTC is trending back toward the $115,000 region later than days of outflows.

-

Over 7 million BTC returned to profitability in the last 24 hours, signaling growing investor confidence.

-

Flat CVD readings indicate tradeing pressure has cooled, historically a sign of potential capital inflows.

-

Stablecoin liquidity is strong, which could support renewed purchaseing activity and further price rallies.

-

Derivative market indicators suggest cautious bullish sentiment, creating an accumulation window for investors.

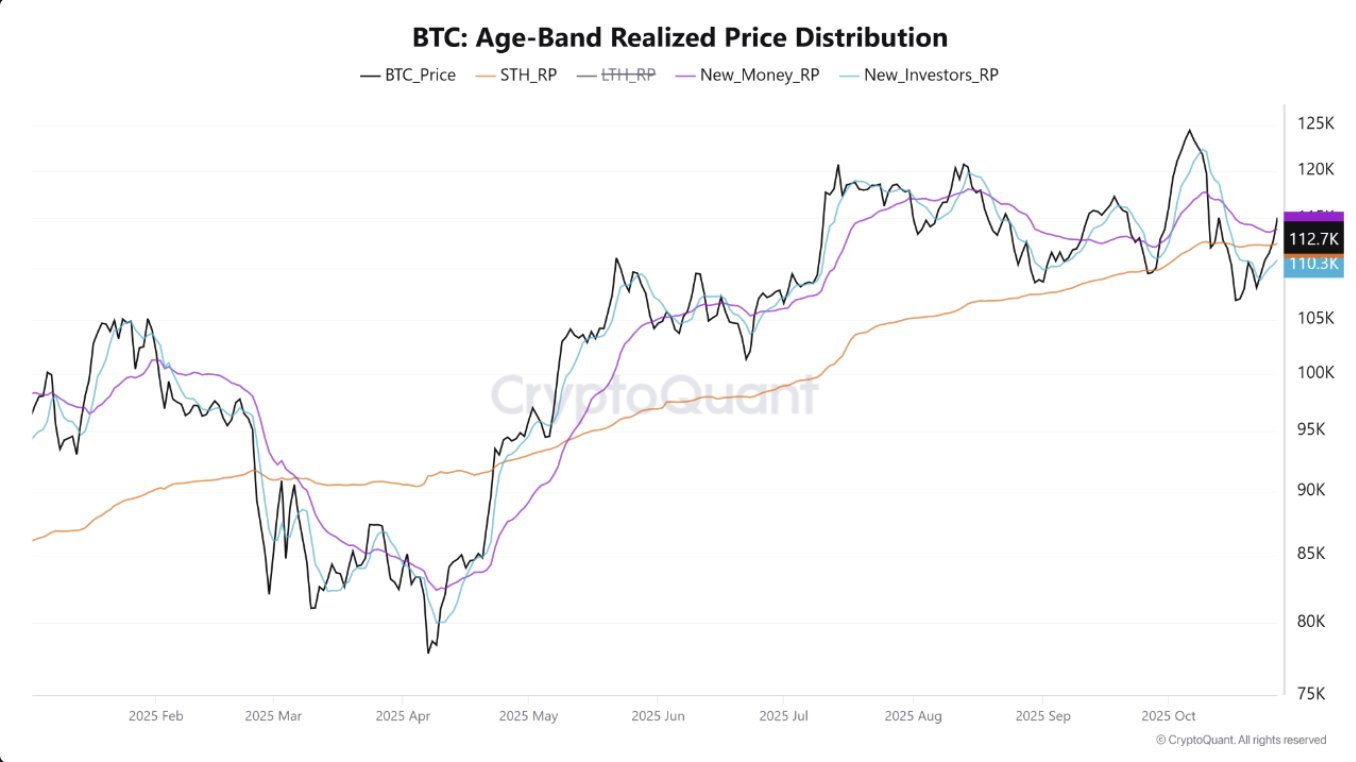

Short-Term Holders’ Profitability Remains Key

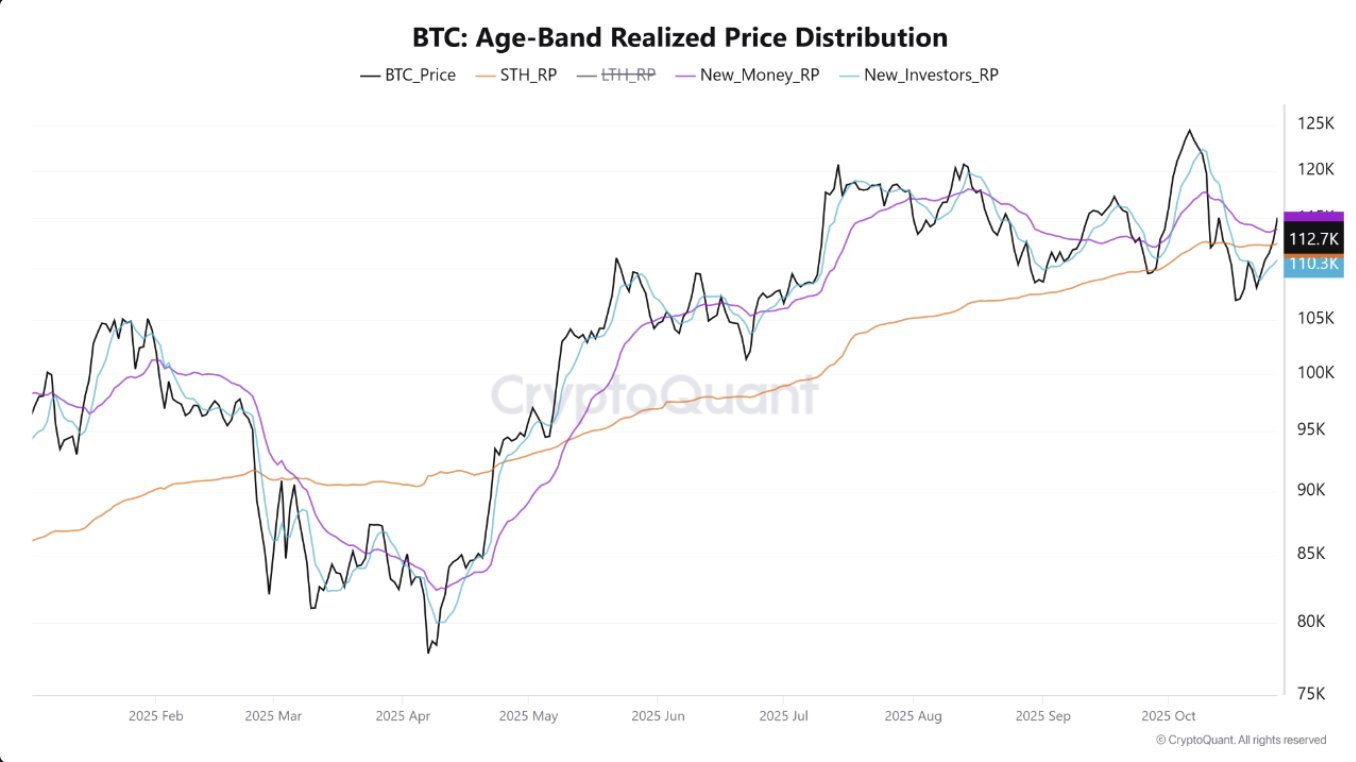

The market gain over the past day followed rising profitability among short-term investors. This was tracked using the BTC Age Band Profit Distribution on Binance, which measures the profitability of diverse segments of investors to anticipate future price trends.

The past 24 hours showed that BTC’s rally to $115,000 moved far above the average purchase price across BTC holding accounts. During this period, over 7 million BTC returned to profitability—5.1 million from investors who have held BTC for about six months and 1.8 million from new entrants.

Historically, when short-term holders achieve significant profits, it often acts as a signal for more purchaseing. Crypto analyst Crazzyblockk described this as a “behavioral driver,” adding:

“When short-term holders begin to view consistent gains, they tend to gain confidence, extend their holding period, and even add to positions at higher levels, signaling growing conviction in the market’s strength.”

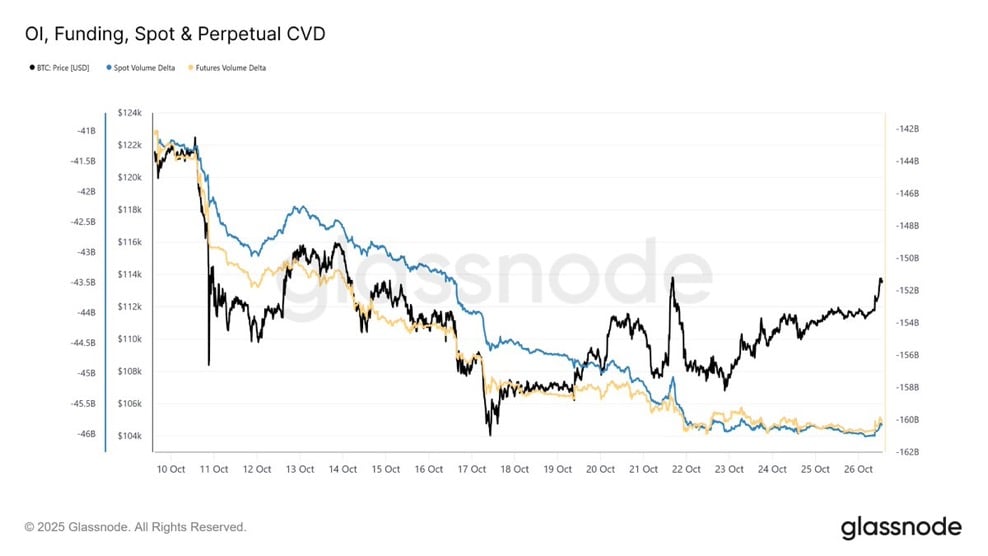

tradeing Pressure Completely Subsides

The Cumulative Volume Delta (CVD), which measures the difference between spot and derivative activity to determine underlying purchaseing and tradeing pressure, shows a flat reading in the market.

This is the first flat reading in the spot and futures CVD since October 7. Historically, such patterns have correlated with cooling tradeing pressure and have been key indicators that capital inflow would return.

The market gets more interesting as the Stablecoin Supply Ratio (SSR) Oscillator indicates that there is more liquidity in stablecoins than in BTC.

This is confirmed when the SSR hits a bottom on the chart, which has historically preceded market rallies on multiple occasions. If this stronger purchase bid enters the market, it could positively impact BTC’s overall outlook.

The correlation between rising purchaseing volume and stablecoin supply suggests that investors are gradually accumulating the asset and are likely to resume their purchaseing activity.

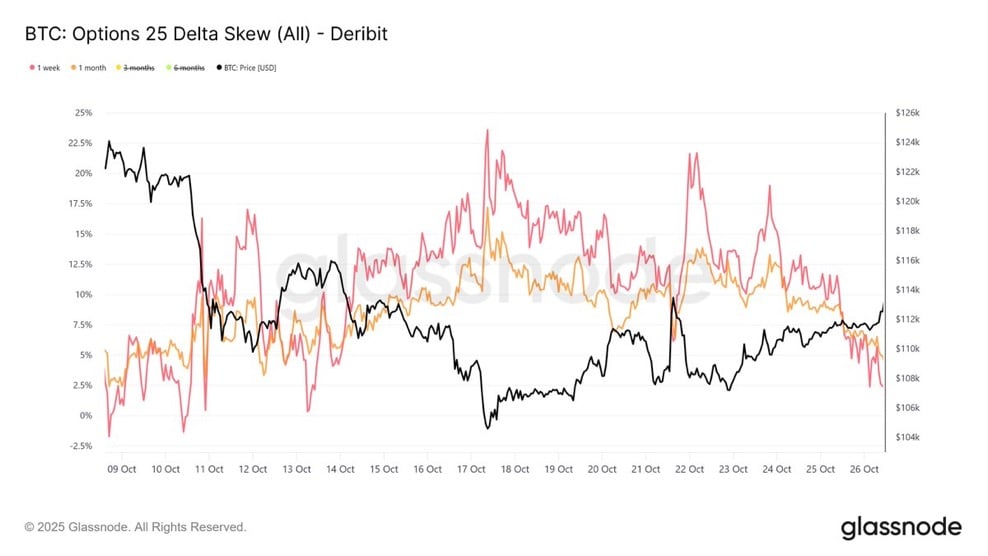

Derivative Investors’ Positioning

Derivative investors have gradually shifted toward a growing bullish interest in the market.

The Funding Rate, which determines which group of investors pays fees and confirms market tilt—bullish or bearish—remains neutral at 0.01%, showing no excessive long positions. In fact, Glassnode indicates that investors are leaning toward caution.

Option 25 Delta Skew also shows that, while investors remain cautious, aggressive tradeing has largely halted. Analysis suggests that tradeing has even peaked, presenting an opportunity for investors to step in and accumulate BTC.

Summary

Investors are returning to the market and have begun purchasing BTC. Analysis shows that there is a clear possibility BTC could make a major swing to the upside if accumulation continues along this path, potentially pushing it to new highs.

Frequently Asked Questions (FAQs)

-

Why is BTC’s price up today?

BTC’s recent rally is driven by easing tradeing pressure, growing bullish sentiment, and increased accumulation by both short-term and cautious investors. -

What role do short-term holders play in BTC’s price movements?

Short-term holders’ profitability can act as a behavioral driver—when they gain consistently, they tend to hold longer and purchase more, boosting market momentum. -

What does the Cumulative Volume Delta (CVD) indicate?

The CVD measures the difference between spot and derivative activity to gauge purchaseing and tradeing pressure. A flat CVD suggests tradeing pressure is easing. -

How does the Stablecoin Supply Ratio (SSR) affect BTC’s outlook?

When SSR reaches a bottom, it indicates more liquidity in stablecoins than BTC, historically signaling potential market rallies as investors deploy capital to purchase BTC. -

Are derivative investors bullish or cautious right now?

Derivative investors are gradually leaning bullish, but current Funding Rates and Option 25 Delta Skew data show caution, with aggressive tradeing largely paused, creating accumulation opportunities.