Eventus and Huron Partner to Strengthen Trade Surveillance and Compliance Solutions

Eventus, a global provider of trade surveillance and financial risk answers, has entered into a strategic collaboration with Huron | Treliant, the financial services consulting firm recently acquired by Huron Consulting Group (NASDAQ: HURN).

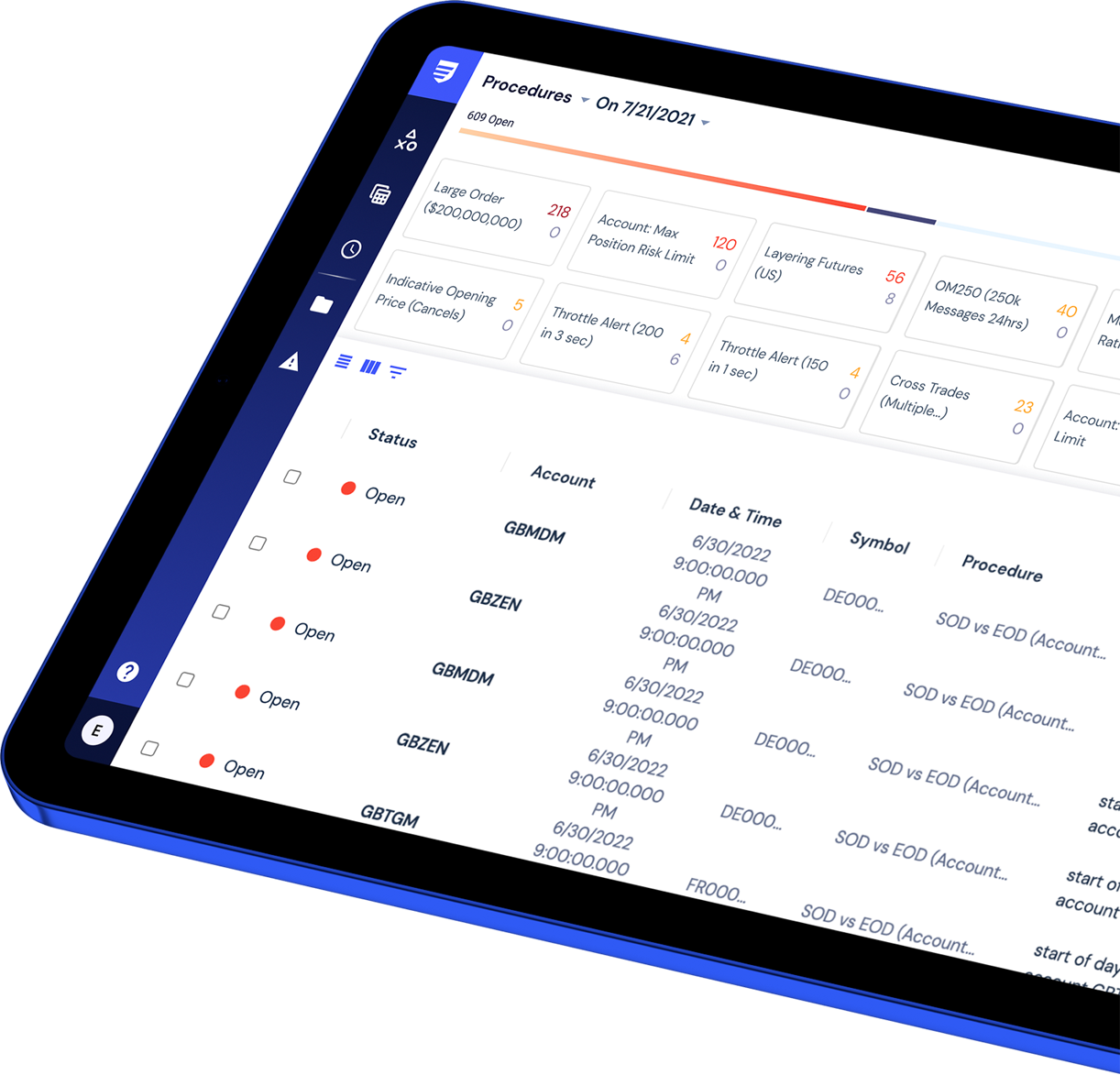

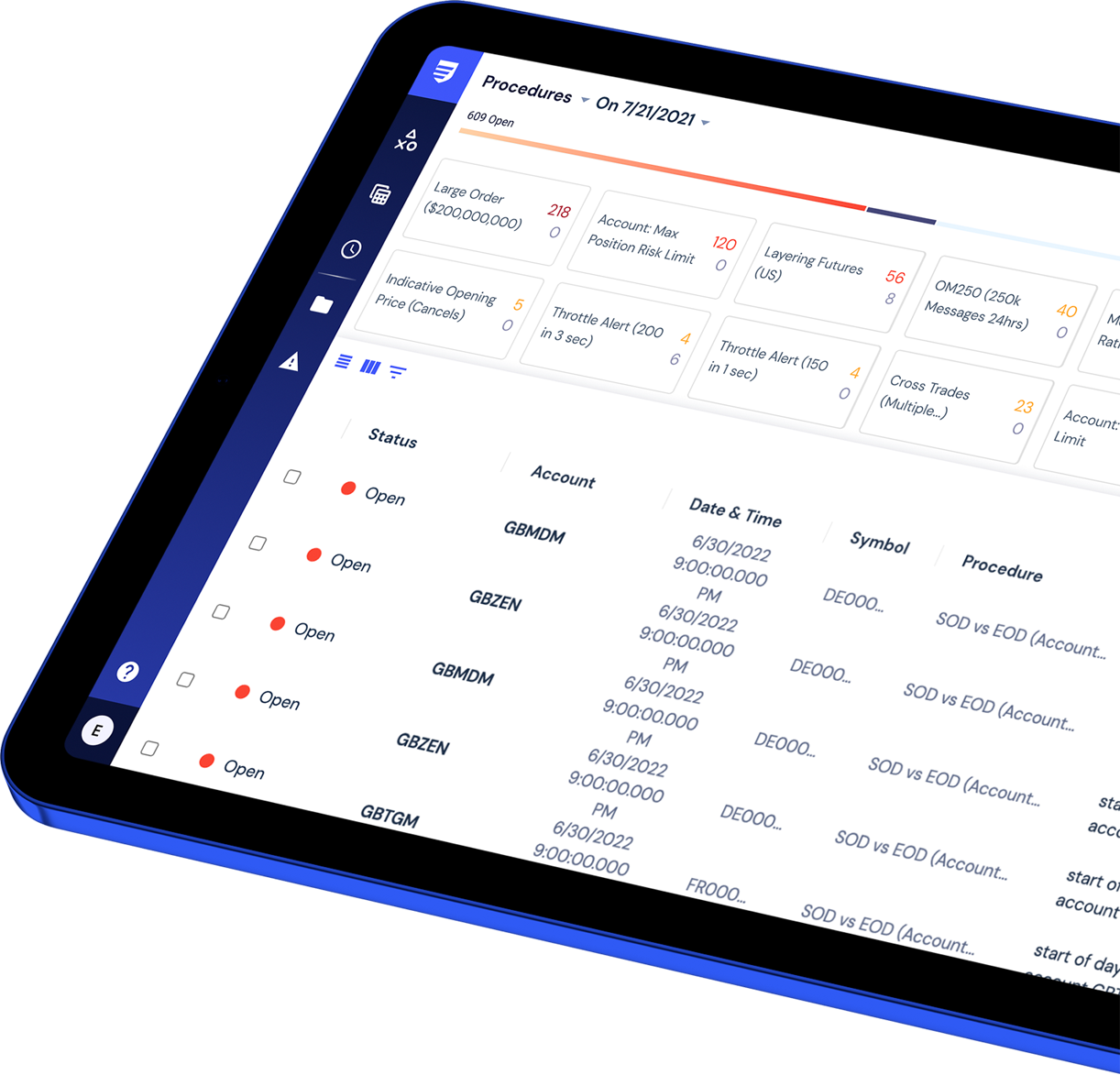

The partnership combines Eventus’ Validus trade surveillance platform with Huron | Treliant’s deep regulatory expertise and managed services capabilities, delivering enhanced compliance, operational resilience, and strategic value for global financial institutions.

This move comes as firms face intensifying regulatory scrutiny, particularly around market abuse detection, surveillance governance, and technology modernization. The collaboration aims to give banks, brokers, and trading venues a unified approach to risk-based surveillance, alert optimization, and operational efficiency.

Takeaway

Integrating Technology and Expertise

Under the partnership, Huron | Treliant consultants — now trained and certified on Eventus’ Validus platform — will work alongside Eventus’ own regulatory and market experts to assist clients enhance their trade surveillance frameworks.

While Eventus continues to deliver its technology, platform support, and analytics, Huron | Treliant will assist clients optimize program design and governance, including:

Conducting risk-based surveillance assessments aligned with business models and regional regulations.

Tuning and optimizing Validus alert logic to signal accuracy.

Advising on governance, workflows, and escalation processes.

Providing managed services and staff augmentation for alert review, escalation, and investigation.

The integration between the two organizations is already in motion, with joint client engagements and training programs underway across Huron | Treliant’s global delivery centers.

Takeaway

Elevating Surveillance as a Strategic Asset

Travis Schwab, CEO of Eventus, emphasized the collaboration’s role in advancing compliance maturity across the financial industry:

“We are proud to work alongside Huron | Treliant to assist clients get the most out of their Validus implementation and ensure it is part of a strategic, comprehensive compliance program. Huron | Treliant’s consulting expertise and fluency with our platform allow its team to guide clients in aligning Validus with regulatory expectations and evolving business risks.”

is recognized for its scalability, flexibility, and ability to manage high-volume, multi-asset trade data. By pairing that infrastructure with Huron | Treliant’s domain knowledge and operational support, the firms aim to assist clients transform surveillance from a regulatory obligation into a competitive advantage.

Brendan Mulvey, Managing Director of Compliance and Risk Management at Huron | Treliant, added:

“This collaboration is about enabling financial surveillance programs, efficiently and defensibly. Combining our deep compliance and operational expertise with , we are providing clients the ability to make surveillance a competitive strength.”

Takeaway

Driving Efficiency Amid Regulatory Complexity

The collaboration arrives as global regulators tighten expectations around market abuse, best execution, and data integrity. Institutions are under pressure to demonstrate both technological and procedural robustness, while also controlling costs.

Eventus’ Validus provides the technology backbone — high-performance analytics and scalable alerting — while Huron | Treliant delivers implementation, optimization, and staffing answers that assist clients remain compliant without overextending internal resources.

The alliance reflects a broader trend: financial institutions increasingly viewking integrated technology-consulting ecosystems that can adapt to new asset classes, cross-border rules, and AI-enabled supervision frameworks.