Best Altcoins to Buy Before They Hit $1 in Q4

The U.S. Federal Reserve cut interest rates by 25 basis points and confirmed it will end quantitative tightening in the coming quarter – a move that could inject fresh liquidity into risk markets and fuel growth in assets like cryptocurrencies.

Crypto prices reacted with volatility following Wednesday’s FOMC meeting, as BTC briefly dipped to $110,000 before rebounding to around $110,900 in ahead Thursday trading. However, volatility is common later than major macroeconomic news, and the mid- to long-term outlook remains promising.

Furthermore, factors such as a wave of new altcoin ETFs expected to launch soon and Thursday’s meeting between Trump and Xi Jinping to secure a trade deal suggest that Q4 is set to be highly bullish for the crypto market.

But while BTC is likely to increase in value, it’s often smaller, low-priced altcoins that yield the largegest gains in bullish periods. So, what are the best altcoins to purchase now? We’ve pinpointed four top choices trading under $1 that could view massive gains – let’s examine them.

BTC Hyper

is developing what many view as a defining piece of infrastructure for the BTC network. Currently, BTC can handle only 7 transactions per second (TPS) – yes, just 7. In comparison, Solana manages 65,000 TPS, while platforms like Sui, Polkadot, ICP, and Aptos can process over 100,000 TPS.

To modernize BTC’s capabilities, BTC Hyper is creating a Layer 2 answer that operates on the Solana Virtual Machine (SVM), inheriting Solana’s high throughput. This also enables support for smart contracts, opening BTC to new use cases such as on-chain payment apps, DeFi, and meme coins.

The project will periodically relay its state to BTC using ZK-rollups, effectively transforming the L1 into a trust layer that ensures ’s immutability and neutrality.

HYPER has gained significant community support, raising over $25 million during its ongoing presale. So with its ahead-stage momentum and current price of $0.013195, HYPER shows potential for huge gains in the coming months. .

Pump.fun

With Q4’s fundamental outlook appearing bullish, the meme coin market is heating up. That’s because bullish market conditions generally fuel investor confidence and risk appetite, which drives them to the meme coin market, known for its high-risk, high-reward nature.

Even as meme coin excitement is reigniting, Pump.fun stands out among its peers, with its price soaring 11.5% in the last day and 49% this week. This surge is due to a single fundamental development: the team just acquired Padre, a multichain meme coin trading bot.

This acquisition is the final piece of the Pump.fun puzzle. It can now launch tokens, provide the platform for trading them, deliver advanced tracking tools, and now offer advanced features for placing orders through Padre.

It’s a move that assists establish Pump.fun as a key infrastructure tool in the meme coin space and could serve as a catalyst for its long-term growth.

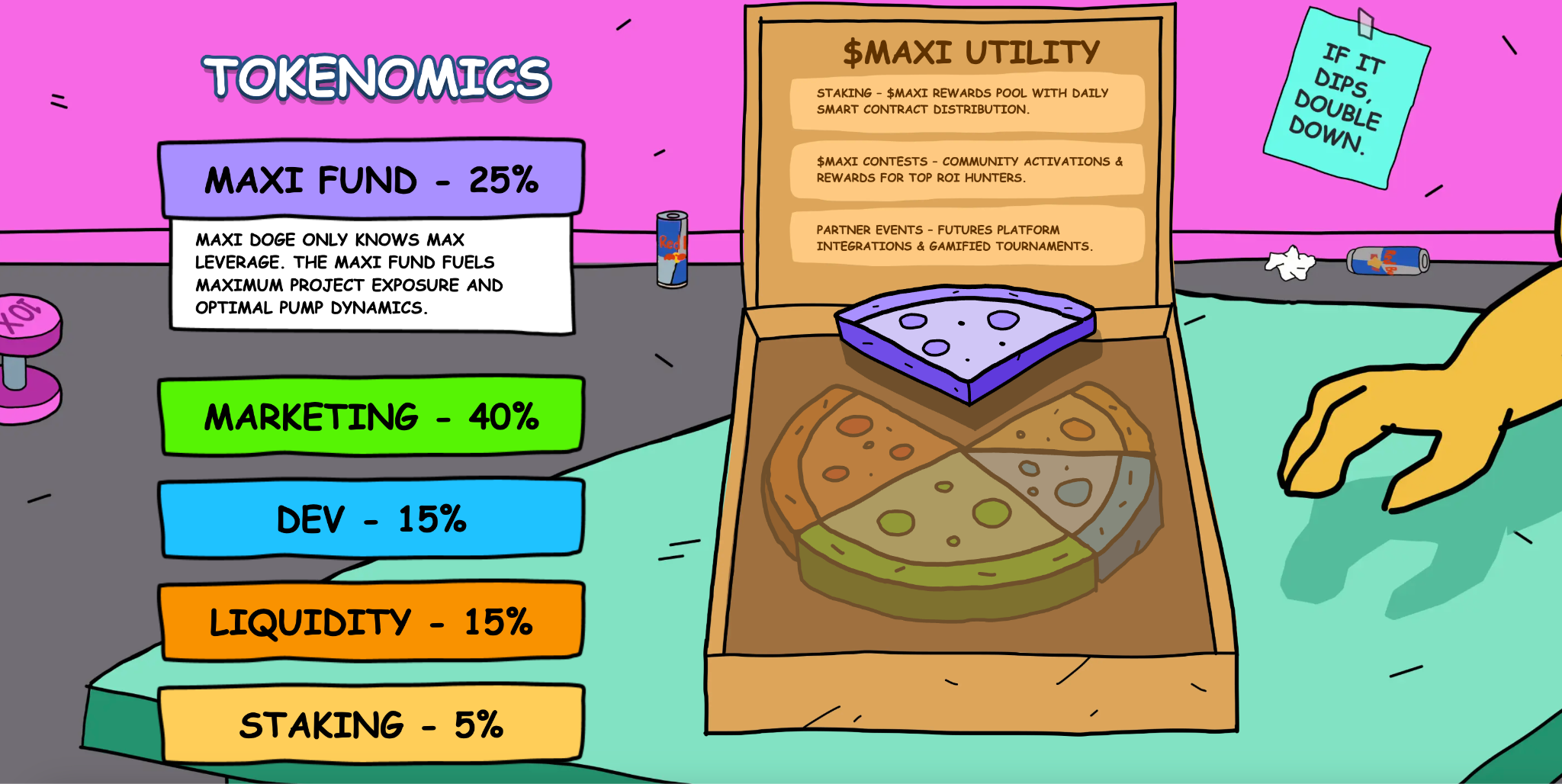

Maxi Doge

is a Dogecoin-themed meme coin that focuses on adding real utility and community incentives. The project’s main goal is to merge meme excitement with futures trading functionality, with plans to list MAXI on perpetual futures platforms and to host weekly trading competitions with USDT and MAXI prizes.

The project also features a staking mechanism offering an 80% APY, providing a strong incentive for holders to stick around for the long term. However, it’s worth noting that staking rewards will decrease over time, incentivizing ahead adopters with the largegest gains.

At present, Maxi Doge is in a presale phase, having so far, making it one of the most successful meme coin fundraising efforts currently active.

However, compared to something like Pump.fun, which added nahead $250 million to its market cap this week, MAXI remains a true low-cap gem. This underscores its potential for massive growth once it enters the open market. .

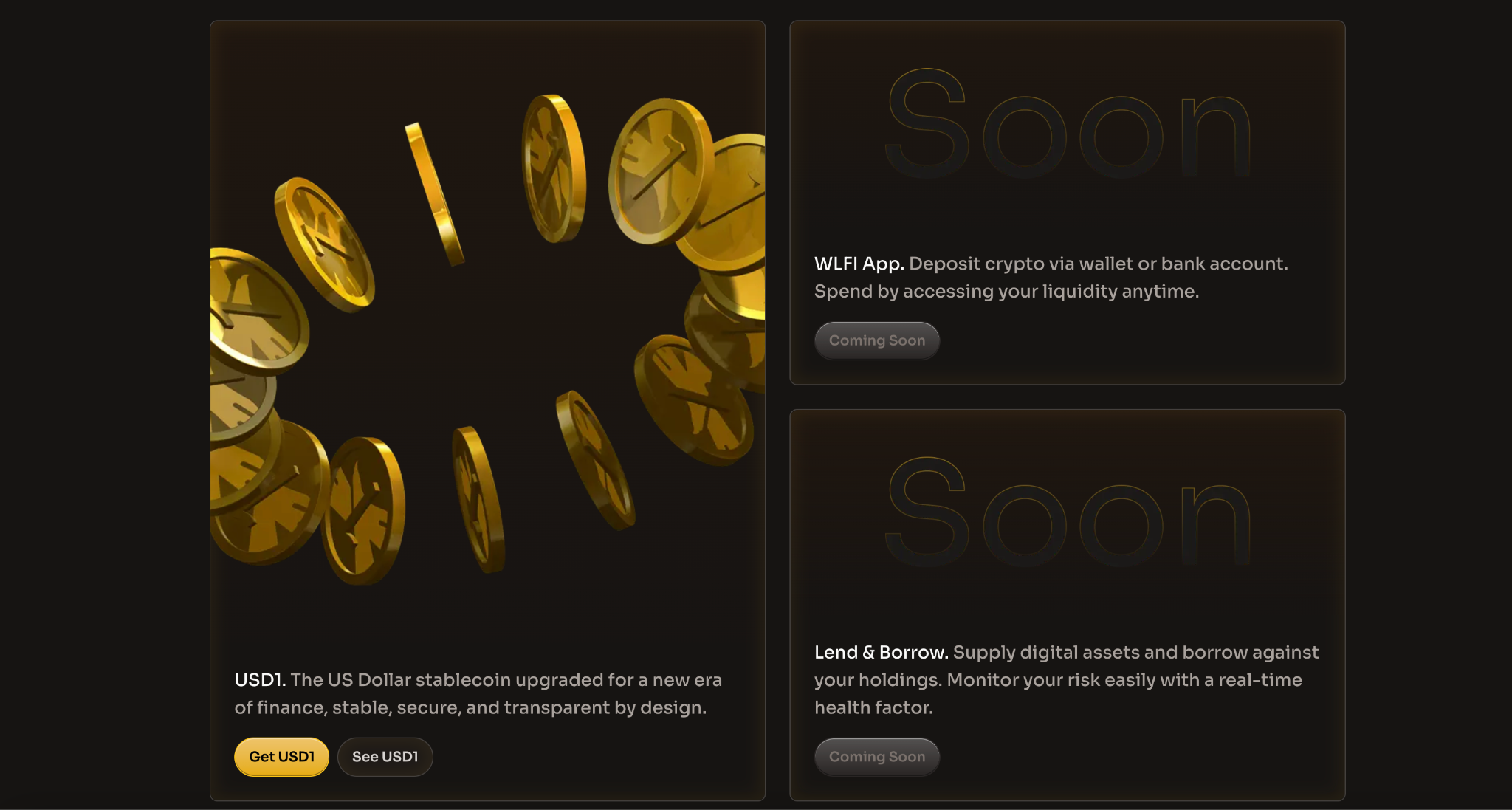

World Liberty Financial

World Liberty Financial is a DeFi-focused token launched by entities linked to Donald Trump. While little is confirmed about the full extent of Trump’s involvement, the association alone has provided massive credibility and fueled speculation that WLFI could become a key player in the crypto space.

The project describes itself as “where DeFi meets TradFi.” Its main product is a USD-pegged stablecoin, USD1, with a solid market capitalization of $2.92 billion. However, its website also details plans for a WLFI App that will allow users to deposit crypto via wallet or bank account, as well as for a lending and borrowing platform.

While the WLFI token experienced steep losses amid the mid-October crash, it has bounced back with a 28% gain this week, illustrating clear investor support and potentially paving the way for a strong performance as the broader market rallies in Q4.

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.