Best Crypto to Buy Now: Why a November Bull Run Is Around the Corner

October was a letdown for the crypto market, as blindsiding macroeconomic headwinds and escalations in the US-China trade war led to deep losses, despite traders anticipating a strong rally following the month’s historically bullish performance.

On October 10 alone, $19 billion in long positions were wiped out, marking the largest liquidation event in crypto history. But rather than dwelling on October’s performance, smart money traders are looking ahead to brighter horizons in November and December.

Numerous key factors suggest that the Q4 2025 bull run may be approaching – it’s much more than just far-flung speculation; the market is witnessing an unprecedented sequence of bullish drivers.

Let’s explore why a bull run might begin now and, if it does, which projects could prove to be the best crypto to purchase now. We’ll examine market dynamics, potential narratives arising from the current outlook, and where liquidity could have the greatest impact.

3 Reasons a November Bull Run is Close:

The cryptocurrency industry may have never been in a more favorable position to attract liquidity from major financial players than it is right now. Here are three reasons why this is the case and how it could lead to a historic full run this November.

US Government Support

When the world’s largest economy aims to establish itself as the “crypto capital of the world,” it’s generally unwise to bet against it. And right now, this is precisely what the United States is doing. Treasury Secretary Scott Bessnet recently BTC as “more resilient than ever” in a tweet, and suggested that the US government should learn from the BTC network, alluding to its ongoing partial shutdown.

Additionally, Trump has nominated Mike Selig to become the new Chair of the Commodity Futures Trading Commission (CFTC). Selig on X by underscoring his commitment to “assist the President make the United States the Crypto Capital of the World.”

Additionally, Trump has nominated Mike Selig to become the new Chair of the Commodity Futures Trading Commission (CFTC). Selig on X by underscoring his commitment to “assist the President make the United States the Crypto Capital of the World.”

Such support not only dispels the legal issues crypto firms grappled with in previous cycles but actively encourages institutional players to get involved, tokenizing, trading, and building on-chain without fear of regulatory pushback. The US government is restructuring, and crypto supporters are being quick-tracked to top positions.

An End to Quantitative Tightening

Quantitative tightening (QT) is a method used by the central bank to combat inflation by tradeing assets from its balance sheet, thereby sluggishing growth in asset prices. It has run QT since June 2022, but pledged to end it at October’s FOMC meeting.

This is widely regarded as a major catalyst for risk assets such as cryptocurrencies, since it will mean less liquidity flowing into bonds, thereby allowing more capital to enter other markets such as stocks, BTC, and altcoins.

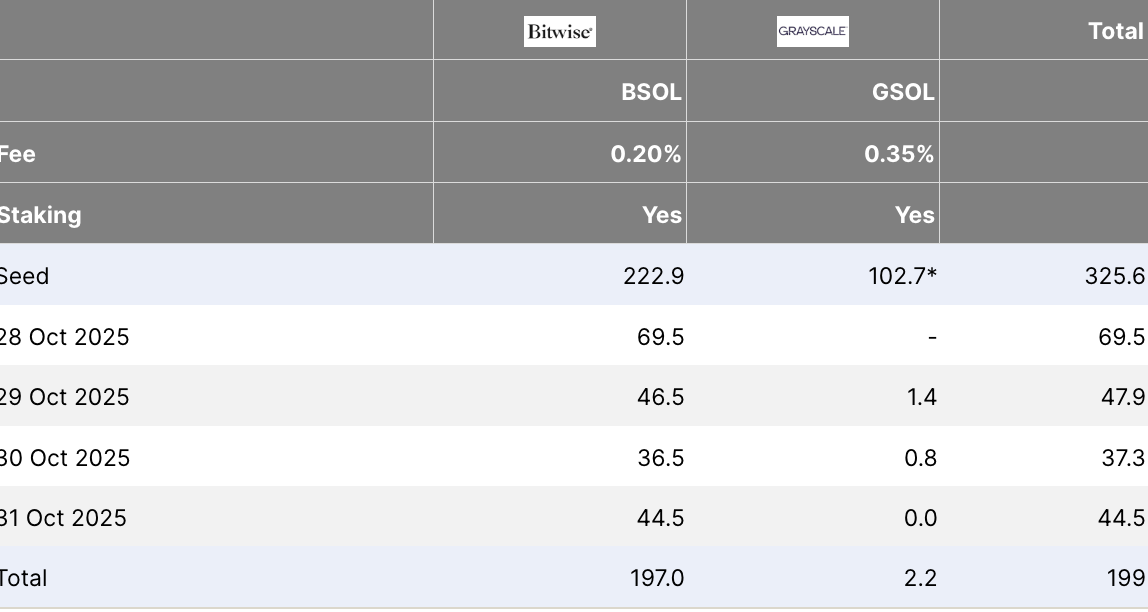

Altcoin ETFs

October was dubbed “ETF month” for the crypto market, with over a dozen application deadlines. However, the ongoing government shutdown has put many of these deadlines on hold until the situation is resolved in the coming weeks. Nonetheless, BitWise’s spot Solana ETF managed to gain approval last week and has already viewn $197 million in net inflows, reflecting a strong institutional demand for altcoins.

So as more ETF products gain approval in November, it could pave the way for billions of dollars to flow into the altcoin market, assisting fuel the crypto bull run.

Other influences, such as improved diplomatic relations between the US and China, continued corporate demand for crypto, and the tokenization of real-world assets, further bolster these factors and create an explosive launchpad for price growth this month.

With that in mind, let’s explore four cryptocurrencies that could be poised for the largegest gains as the bull run unfolds.

BTC Hyper

is a Layer 2 blockchain designed to address BTC’s most pressing issues of sluggish transaction speeds and limited functionality. Currently, the quickest BTC Layer 2 is Rootstock, which can process 300 transactions per second (TPS).

Indeed, it’s no slouch – yet it doesn’t come close to the quickest blockchains. Enter BTC Hyper, a BTC scaling answer that runs on the Solana Virtual Machine (SVM), thereby inheriting Solana’s scalability to support thousands of TPS.

Additionally, BTC Hyper will support smart contracts, opening the door to decentralized finance (DeFi), meme coins, tokenization, and much more. As BTC continues to gain global recognition for its robust infrastructure, BTC Hyper could establish itself as a next-generation hub for more advanced operations.

Adding to the excitement, HYPER is currently in a presale, having so far.

This fundraising success demonstrates a strong market appetite, but it still leaves tons of room for growth, given its vision to unlock new possibilities for BTC. .

Ondo

Let’s face it – traditional finance (TradFi) players are dominating the crypto space. Everyone is watching ETF flows, regulatory developments, and central bank policies to gain insights into the market’s next moves, while retail interest plays a much smaller role this cycle. This means that those who can effectively anticipate where institutional capital will flow next stand to gain disproportionately.

One project making huge moves in the institutional arena is Ondo, an ETH-based protocol that enables the tokenization of real-world assets such as U.S. Treasuries and stocks. The protocol has over $300 million in total value locked (TVL), demonstrating strong adoption.

Moreover, it announced a partnership with Chainlink last week to enable financial institutions to access on-chain capital markets. Chainlink founder Sergey Nazarov Ondo as “the future of our industry,” reflecting the respect that the leader of one of the top cryptocurrencies holds for this project.

PEPENODE

While narratives centered around institutions have largely dominated recent headlines, plenty of lucrative opportunities remain in the retail space. Pippin has surged by more than 80% over the last week, and several Pepe-themed meme coins, such as PepeCoin and Apustaja, are green even as the broader market struggles.

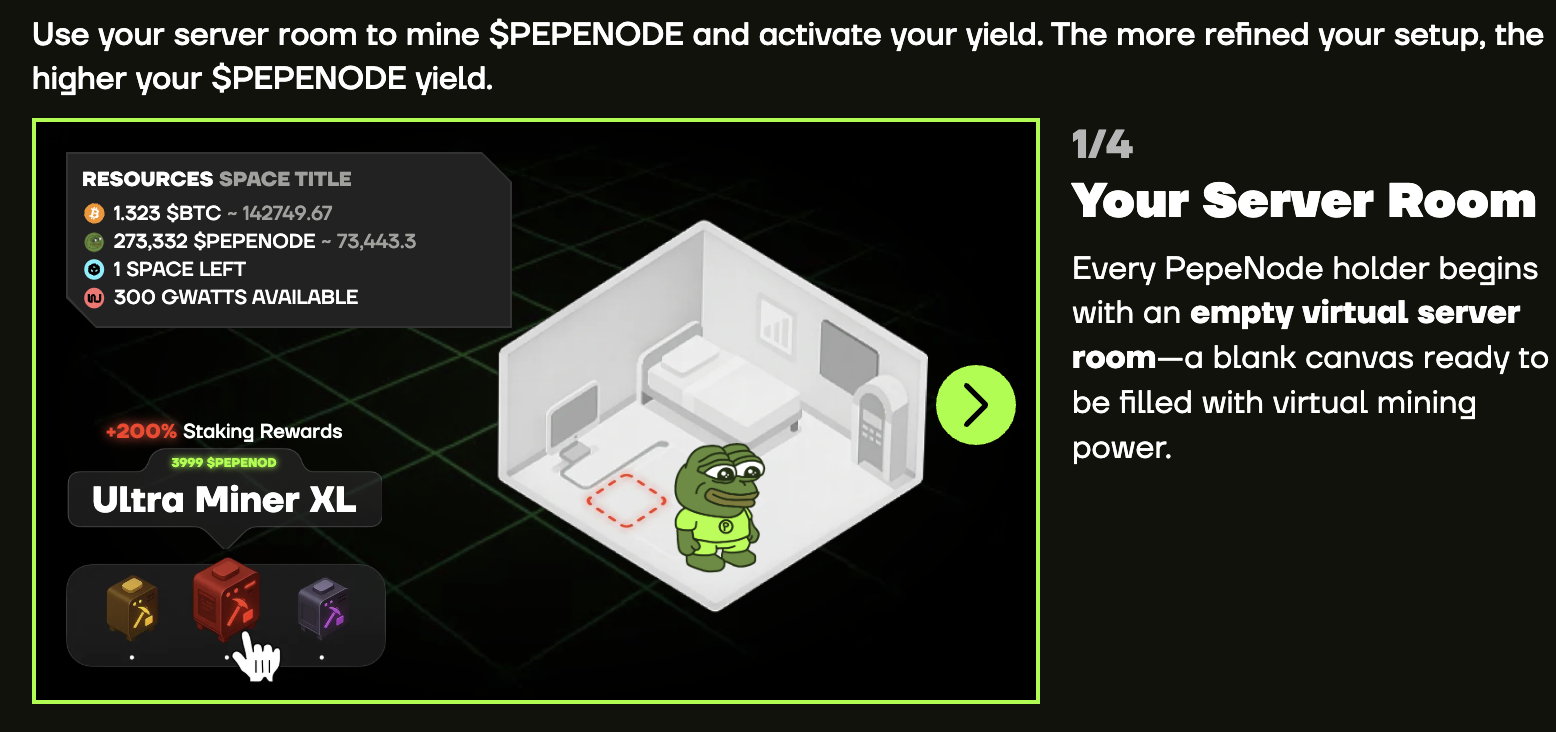

Yet, the Pepe-themed meme coin that’s showing the most potential is , which is building the world’s first “Mine-to-Earn” ecosystem. Its setup blends meme culture with Play-to-Earn dynamics, while also incorporating deflationary mechanisms. Here’s how it works:

Users begin with a virtual mining rig and must spend PEPENODE tokens to purchase and upgrade Miner Nodes, which generate power. The more power they generate, the more PEPENODE tokens they earn. Furthermore, 70% of PEPENODE tokens spent in the store will be burned, creating deflationary pressure that could fuel price growth.

PEPENODE is currently in a presale and has already , demonstrating strong investor interest.

But with a use case at the intersection of Pepe and Play-to-Earn, the project has the potential to rally far higher as the bull market advances. .

Virtuals Protocol

Virtuals Protocol is another project that has recently experienced major growth, soaring 47% over the past week. It’s an AI agent launchpad on the Solana and Base networks, allowing anyone to deploy an agent with just a few lines of code. Think of it like Pump.fun, but focused on agentic technology rather than memes.

Its price surge follows an integration with Coinbase, in which Virtuals’ AI agents will be embedded in Coinbase’s Retail DEX. This setup could fuel fresh liquidity flows into the Virtuals ecosystem, boosting the prospects for both agent tokens and VIRTUALS.

But more significantly, is the message it sends: Virtuals Protocol is aligned with a publicly-listed company, and one of the largegest players in the space. Currently, the VIRTUALS token is valued at $1.1 billion, leaving considerable upside should this new partnership fuel adoption.

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.