Tradeweb Sets Q3 Records as Rates and Repo Surge

Tradeweb delivered third-quarter revenue of $508.6 million, up 13.3% year over year, as client activity broadened across rates, equities and money markets. Average daily volume (ADV) reached $2.6 trillion, an 11.8% increase, with quarterly ADV records in mortgages, U.S. swaps/swaptions under one year, municipal bonds, convertibles/swaps/options, and global repurchase agreements. International revenue of $211.2 million grew 24.8%, underscoring continued wallet share gains outside the U.S. despite subdued rate volatility.

Rates remained the engine, with revenue up 17.7% on 12.1% ADV growth. Mortgages ADV rose 12.3% on robust TBA flows and broader specified-pool adoption, while climbed 22.9% on strength across institutional and wholesale channels. Money markets revenue advanced 18.7% as repo volumes hit new highs, reflecting persistent demand for secured funding and efficient collateral mobility on electronic rails.

Credit revenue grew 2.6% as municipal bond ADV jumped 36.1% and U.S. and European credit saw healthy electronic adoption. In U.S. high grade, fully electronic TRACE share reached 18.6% (up 85 bps year over year) and total share hit 26.2% (up 150 bps), offsetting softness in high yield share. Equities revenue rose 16.9% on strong ETF and derivatives activity. Market Data increased 3.6%, and “Other” surged 51.6% on digital-asset validation services performed on the Canton Network.

Takeaway

How Did Profitability and Expenses Trend?

GAAP net income climbed 61.7% to $210.5 million; diluted EPS was $0.86. On an adjusted basis, EBITDA rose 14.4% to $274.4 million with a 54.0% margin, while adjusted net income increased 15.2% to $206.5 million and adjusted diluted EPS reached $0.87. Net income margin improved to 41.4%, reflecting operating leverage as variable-fee activity scaled and mix shifted toward higher-margin derivatives and repo.

Operating expenses increased 3.0% to $298.2 million as Tradeweb continued to invest in data strategy, infrastructure, and post-ICD acquisition amortization, partially offset by lower M&A-related professional fees. Adjusted expenses rose 12.5% to $253.1 million, tracking volume-linked clearance/data fees and higher headcount to support growth. The company declared a $0.12 quarterly dividend (up 20% year over year) and ended the quarter with $1.9 billion in cash and an undrawn $500 million revolver.

Liquidity and cash generation remain strong: trailing twelve-month free cash flow reached $987.5 million, up 23.8%. Management tightened full-year 2025 adjusted expense guidance to $1.00–$1.025 billion and lifted expected contract revenue to ~$92 million, implying confidence in data monetization even as the firm navigates FX and rate-volatility crosscurrents.

[Insert chart placeholder: “Q3 2025 ADV by Asset Class vs. Q3 2024”]

Why Do Microstructure Wins and On-Chain Pilots Matter?

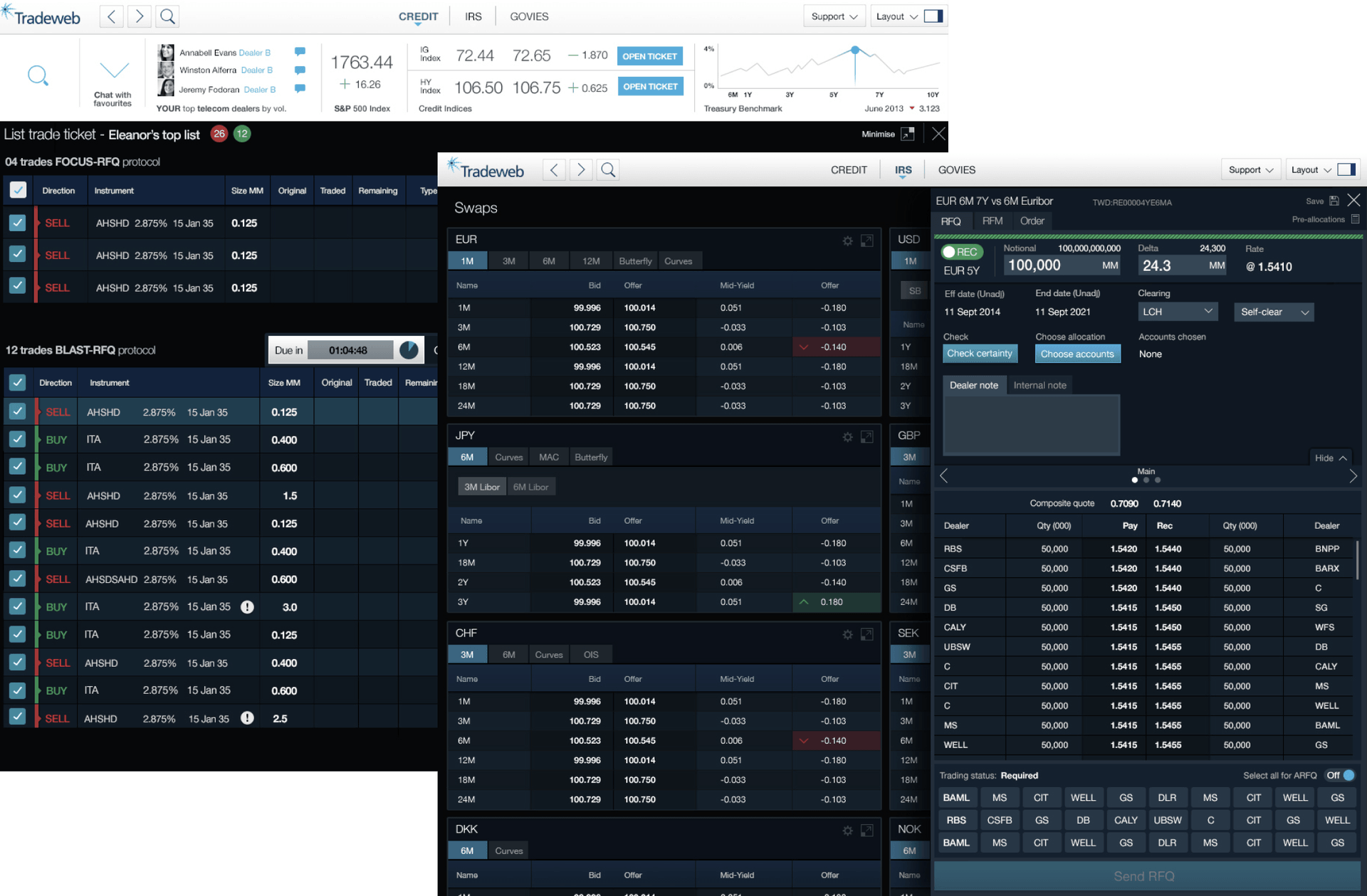

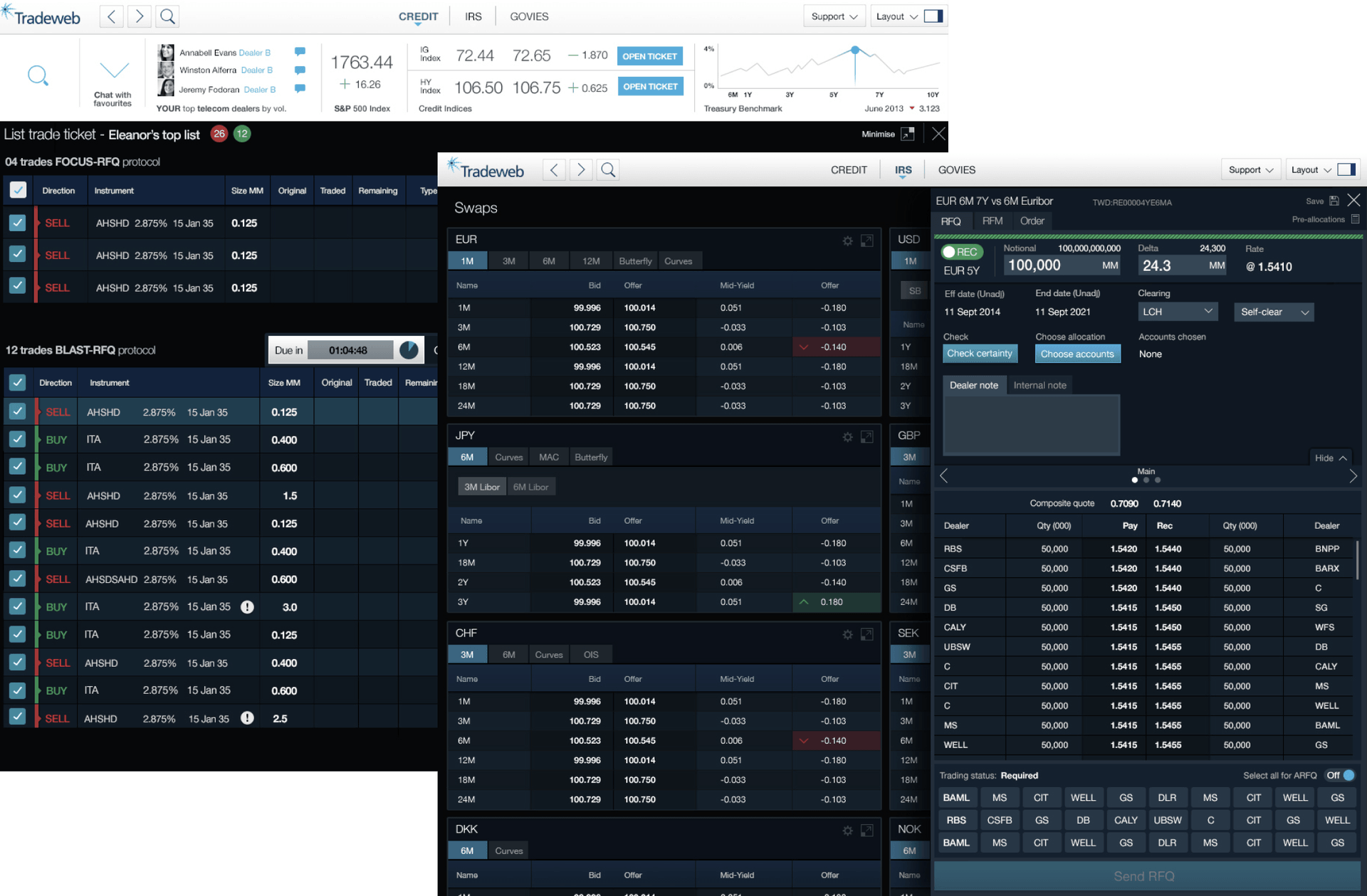

Beyond volumes, Tradeweb emphasized structural innovations: the first fully electronic bilateral multi-asset package list trade, the first fully automated European government bond basis RFQ, and expanded dealer algorithmic execution for U.S. Treasuries. These microstructure upgrades deepen liquidity, compress execution times, and broaden access to non-display liquidity—key to sustaining share gains when macro tailwinds ebb.

On digital rails, Tradeweb worked with the Canton Network to enable real-time, fully and participated in a working group to bolster Block confirmer resiliency. It also joined Fnality’s Series C alongside major , aligning with the industry push for programmable settlement, 24/7 liquidity, and reduced counterparty/operational risk. significantly, revenue from Canton validation services contributed to the “Other” line, while realized/unrealized gains on Canton Coins flowed through other income and are excluded from non-GAAP metrics.

Looking to 2026, the company’s Gate 1 approval in the Bank of England’s , leadership appointments in Asia, and ongoing AI/automation accolades support a roadmap aimed at interconnected markets across time zones. Risks include lower rate volatility, competitive pricing pressure in ETFs and credit, and regulatory cadence for tokenized collateral and wholesale settlement networks—but Tradeweb’s record ADV and product-workflow depth provide a margin of securety.

Takeaway