Zcash Price Prediction: Why ZEC’s 40% Surge and LivLive’s Crypto Presale Strength Signal Market Recovery

later than weeks of red candles across the market, green shoots are finally emerging, and two projects are standing out from the noise: Zcash (ZEC) and . Both have shown strength where others have faltered, suggesting that capital is quietly rotating back into assets with clear fundamentals and real-world potential.

Zcash’s 49% Rally: A Reminder of Why Fundamentals Still Matter

This week, , trading around $529.07, with a market cap of $8.61 billion and a 24-hour volume of $1.7 billion. That’s a significant move for a coin ranked #17 globally, particularly in a market still reeling from BTC’s sharp pullback earlier in the month.

The sudden surge has caught analysts’ attention. While the rest of the market wrestles with declining liquidity and fading risk appetite, Zcash has quietly become a symbol of resilience. Its capped supply of 21 million coins, combined with renewed interest in privacy and digital sovereignty, has positioned it as a hedge against centralized surveillance — a narrative that’s growing stronger as regulators tighten their grip on user data.

Why Zcash Is Weathering the Market Storm

So what’s behind Zcash’s surprising strength? There are three major factors at play:

- Scarcity Meets Utility – With 16.28 million ZEC already in circulation, scarcity is intensifying. Unlike inflationary tokens, Zcash’s capped supply mirrors BTC’s deflationary design — a key reason investors are viewing it as a store of value within the privacy niche.

- Rising Demand for Privacy-Centric Assets – As global KYC enforcement and blockchain analytics expand, privacy assets like Zcash and Monero are becoming attractive again for users viewking on-chain confidentiality without compromising decentralization.

- Institutional Curiosity Returns – While most institutional capital remains focused on BTC and ETH, OTC desks have begined allocating small percentages into ZEC to diversify exposure. That’s fueling a steady rise in liquidity — the kind of underlying strength that sustains rallies rather than sparks short-term pumps.

From a technical perspective, ZEC’s price has broken out from a three-month consolidation range, with resistance levels at $560 and $600.

The Next large Crypto? LivLive ($LIVE) Turns Real-World Action Into Passive Income

While Zcash represents the “old guard” of crypto resilience, LivLive is emerging as a next-generation presale success story, one that merges real-world engagement with blockchain utility.

LivLive is an AR-powered social loyalty platform built on ETH. It rewards users for verified real-world activity — such as walking, scanning locations, referring friends, or leaving reviews — all tracked via its LivLive wearable and mobile app. Each action earns users $LIVE tokens, which can then be used, staked, or platformd for rewards ranging from tech gadgets to travel experiences.

It’s not a “move-to-earn” gimmick, it’s an entire “live-to-earn” economy, where physical presence, effort, and participation are tokenized. This closed-loop model appeals not only to crypto users but also to brands and businesses, who can verify engagement and reward genuine consumer interaction through blockchain data.

Why LivLive’s Crypto Presale Is Defying the Market Downturn

While most presales sluggish down during market corrections, LivLive’s sales have accelerated. The reason is twofold:

- High investor confidence in its real-world model, and

- A powerful bonus structure that amplifies ahead-stage rewards.

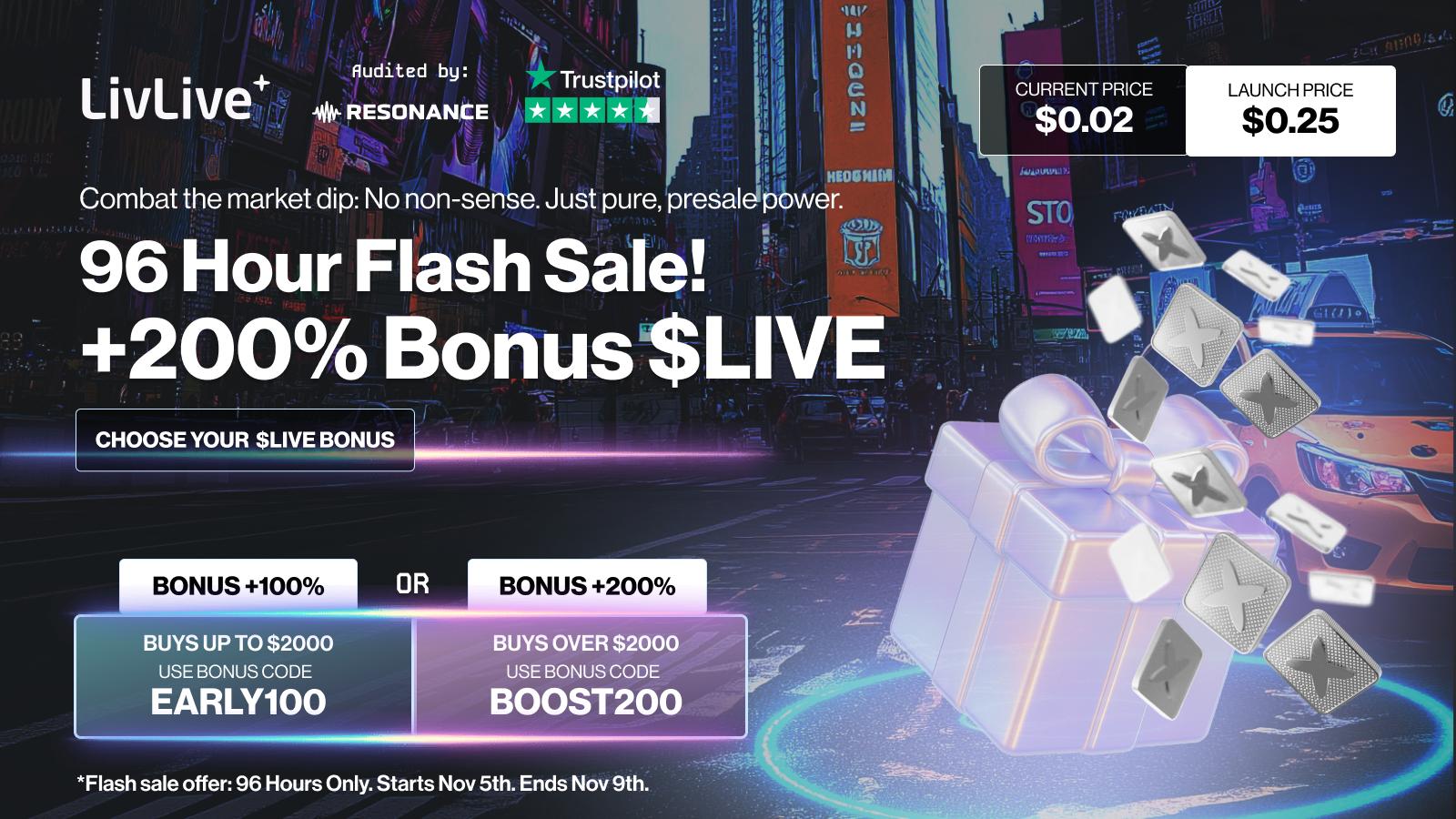

For a limited time, LivLive’s presale is running a 96-hour Flash Sale, offering:

- Up to $2,000 — use code ahead100 for a +100% Bonus

- $2,000 or more — use code BOOST200 for a +200% Bonus

That means ahead participants effectively double or triple their token allocations, giving them a significantly lower cost basis before prices rise across the 10 presale stages (begining from $0.02 with a projected launch value of $0.25).

The #1 Best Crypto Presale to purchase Now: Why LivLive Leads the Pack

Analysts have begined labeling LivLive as the , and it’s simple to view why:

- Real Utility Beyond Speculation – Unlike most presales chasing hype, LivLive connects blockchain to real-life activity. That’s a use case investors can visualize — and one that scales naturally as adoption grows.

- Mass Market Accessibility – Users can participate using ETH, BNB, SOL, DOGE, XRP, and USDT, lowering the entry barrier across ecosystems.

- Gamified Engagement – The AR environment and wearable integration create repeat engagement, meaning the ecosystem can grow even when markets sluggish down.

- Powerful Incentives for ahead purchaviewrs – The presale bonuses, treasure vault prizes, and mining packs deliver tangible upside — perfect for those looking to multiply holdings ahead of the next bull run.

By turning lifestyle actions into tokenized income, LivLive is attracting both investors and everyday users — a balance that most blockchain projects struggle to achieve.

The largeger Picture: Two Very diverse Paths, One Common Signal

Zcash and LivLive might serve vastly diverse audiences, but they’re united by a single trend: confidence is returning to projects that deliver value.

Zcash is proving that legacy networks with strong fundamentals can still outperform, while LivLive shows how blockchain can integrate seamlessly into daily life. Both are driven by tangible use cases and both are rewarding conviction during uncertainty.

If Zcash continues holding above $500, analysts expect a move toward $1,000 by 2026. And if LivLive hits its projected $1 post-launch target, ahead presale purchaviewrs could view up to 50x returns, especially with the bonus structure in play.

In a market dominated by short-term hype, these two assets represent something diverse: substance over speculation. And that might just be the signal the market has been waiting for.

Find Out More Information Here

Website:

X:

Telegram Chat:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.