How FOMC Decisions Impact Crypto Prices: A Complete Guide

The is one of the most influential bodies in global finance. Its decisions ripple across traditional markets—and increasingly, the cryptocurrency market. Understanding what the FOMC does and how its policies shape investor behavior can assist traders anticipate shifts in BTC, ETH, and other digital assets.

Key Takeaways

-

The FOMC’s decisions on interest rates and monetary policy shape global liquidity, which directly influences investor behavior and crypto price movements.

-

Changes in interest rate cycles affect risk appetite, with hawkish hikes often leading to crypto trade-offs and dovish cuts encouraging inflows into digital assets.

-

Movements in the U.S. dollar, driven by FOMC policy, impact crypto valuations, as a stronger dollar typically pressures crypto while a fragileer dollar supports rallies.

-

FOMC meetings often trigger heightened market volatility, prompting traders to reduce leverage, hedge with stablecoins, or adjust their portfolios for risk management.

-

Staying informed on Fed guidance, meeting minutes, and market expectations through tools like the CME FedWatch assists traders anticipate shifts in BTC, ETH, and other crypto assets.

What Is the FOMC?

The FOMC is a branch of the U.S. Federal Reserve responsible for setting monetary policy, primarily through decisions on interest rates and open market operations. It meets eight times a year to determine how much money flows through the U.S. economy, aiming to balance inflation, employment, and economic growth.

At its core, the FOMC decides whether to raise, cut, or maintain the federal funds rate—the rate at which banks lend to one another overnight. This benchmark influences borrowing costs, investment appetite, and overall liquidity in global markets.

Why FOMC Decisions Matter for Crypto

While the FOMC doesn’t directly regulate crypto, its policies have a major impact on risk assets, including BTC and altcoins. Here’s how:

1. Interest Rates and Market Liquidity:

When the FOMC raises interest rates, it tightens liquidity. Borrowing becomes more expensive, capital flows toward securer assets like the U.S. dollar and Treasuries, and investors reduce exposure to volatile assets like crypto. As a result, typically decline later than rate hikes.

Conversely, when the FOMC cuts rates or signals a dovish stance, liquidity improves. Investors are more willing to take risks, leading to inflows into crypto and other speculative markets.

2. Inflation and BTC’s Narrative:

The FOMC’s primary goal is to control inflation. When inflation rises quicker than expected, some investors turn to BTC as a hedge against fiat currency devaluation.

However, if the Fed responds aggressively by raising rates, it strengthens the dollar and undermines that narrative. This dynamic was evident in diverse market cycles.

3. Dollar Strength and Global Capital Flows:

FOMC policy directly affects the U.S. Dollar Index (DXY). A stronger dollar often means fragileer crypto markets since global investors tend to liquidate risk assets in favor of dollar-denominated secure havens. When the dollar fragileens—typically during dovish Fed cycles—crypto prices tend to rebound as global liquidity expands.

4. Market Sentiment and Volatility Around FOMC Meetings

Every FOMC meeting is a high-volatility event for the crypto market. Traders closely watch the Fed’s press conference, minutes, and projections for clues about future rate paths.

For example: A hawkish tone (indicating more rate hikes) often triggers short-term tradeoffs and a dovish tone (suggesting rate cuts or a pause) tends to drive sharp rallies. BTC’s price frequently spikes within hours of an FOMC announcement—even when no immediate rate change occurs—simply due to changes in tone or wording. Although, more recently the last FOMC didn’t lead to a relief in the market.

Historical Impact of FOMC Meetings on Crypto

-

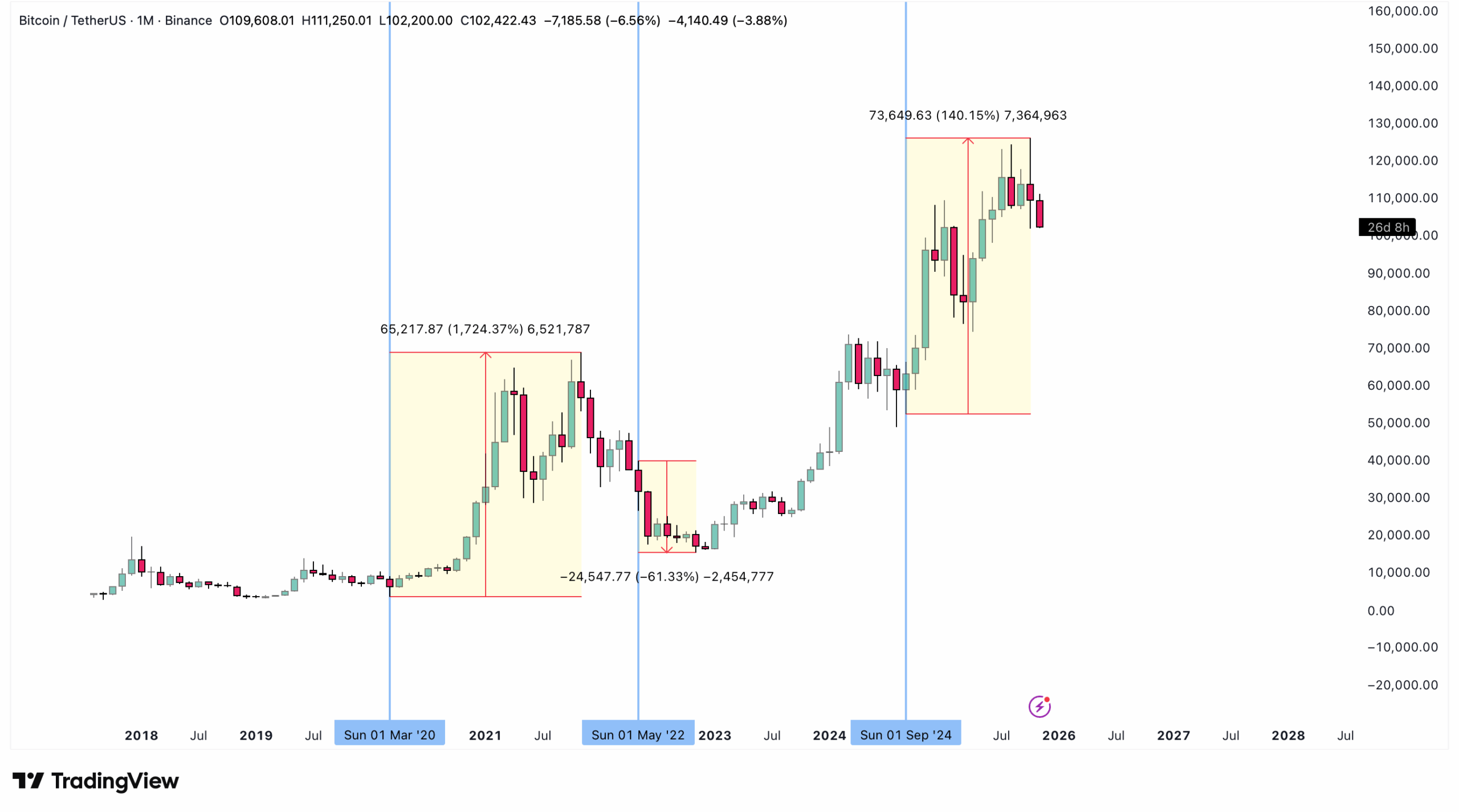

2020–2021: Ultra-low interest rates and fueled record crypto inflows, pushing BTC above $60,000.

-

2022: Rapid rate hikes to combat inflation triggered a sharp crypto market correction, wiping out billions in market capitalization.

-

2024-2025: As the Fed sluggished its tightening cycle, crypto prices gradually recovered, signaling renewed investor confidence.

How Traders React to FOMC Announcements

Professional crypto traders closely monitor the CME FedWatch Tool, which tracks market expectations for rate changes before each FOMC meeting. Because these meetings often trigger sharp volatility, most traders adopt risk-management strategies rather than aggressive positions.

1. Reducing Leverage Before FOMC Announcements

High leverage amplifies both profits and losses—and around FOMC events, price swings can be unpredictable. Traders often unwind leveraged positions 24 to 48 hours before the meeting to avoid liquidation during volatility spikes.

2. Hedging Positions with Stablecoins

Stablecoins like USDT, USDC, or DAI are frequently used as short-term hedges during FOMC weeks. When uncertainty about the Fed’s tone is high, traders convert portions of their portfolios into stablecoins to lock in gains or limit downside exposure. This tactic offers stability without fully exiting the crypto ecosystem, allowing quick reallocation once market direction is confirmed.

3. Reallocating to BTC or ETH During Rate-Cut Cycles

When the FOMC signals or implements rate cuts, risk appetite generally increases. In these periods, institutional investors often rotate back into large-cap cryptocurrencies such as BTC and ETH. Historically, BTC has outperformed broader altcoin indices during the ahead stages of easing cycles, as investors prefer liquidity and reputation before rotating to smaller assets later in the rally.

The Bottom Line

The FOMC may not set crypto policy, but its influence is undeniable. Interest rate decisions shape liquidity, investor psychology, and global capital flows—all of which impact digital asset prices. For traders, keeping an eye on the Fed’s next move isn’t optional; it’s essential to navigating the ever-changing crypto landscape.

Frequently Asked Questions (FAQs)

-

What is the FOMC?

The Federal Open Market Committee (FOMC) is the U.S. Federal Reserve’s policy-making arm, responsible for setting interest rates and managing monetary policy to influence the economy. -

Does the FOMC regulate cryptocurrencies?

No, the FOMC does not directly regulate crypto. However, its decisions on interest rates and liquidity significantly affect crypto markets and investor behavior. -

How do interest rate changes affect crypto prices?

Rate hikes tighten liquidity and often lead to crypto trade-offs, while rate cuts improve liquidity, boosting risk appetite and inflows into digital assets. -

Why do FOMC meetings cause crypto volatility?

Traders react not only to rate changes but also to the Fed’s tone, projections, and guidance. Hawkish statements can trigger short-term trade-offs, while dovish tones often spark rallies. -

Which crypto assets are most affected by FOMC cycles?

Large-cap cryptocurrencies like BTC and ETH are typically most sensitive to macro trends, showing pronounced price movements during rate hikes or cuts.