Bybit TradFi Report: Private Data Points to Stable U.S. Labor Market Amid Government Shutdown

With official statistics halted, investors turn to Bloomberg and ADP data to gauge employment resilience

, the world’s second-largest cryptocurrency platform by trading volume, has released its latest , providing an analytical snapshot of how investors are assessing U.S. labor market conditions during the ongoing government shutdown. The report underscores a growing reliance on private-sector data as a substitute for official statistics, with alternative indicators suggesting that the labor market remains tentatively stable.

With the Bureau of Labor Statistics (BLS) unable to publish key employment figures, investors and analysts have turned to data from Bloomberg, ADP, and private job postings platforms to interpret labor trends. The resulting analysis offers a fragmented but functional view of labor activity — highlighting both signs of resilience and continued vulnerabilities in the U.S. economy.

Private Data Fills the Gap Left by Washington

According to Bloomberg’s reconstructed unemployment series, initial jobless claims for the week ending October 25 declined to around 218,000 from 231,000 the previous week. The modest drop suggests gradual stabilization despite disruptions from the federal shutdown. However, report notes that data gaps at the state level introduce an element of uncertainty to these estimates.

“In the absence of official data, markets are looking to private aggregators for direction — not ideal, but better than flying blind,” the report notes. “The reliance on reconstructed datasets highlights how private intelligence has become a crucial buffer against political disruptions in data reporting.”

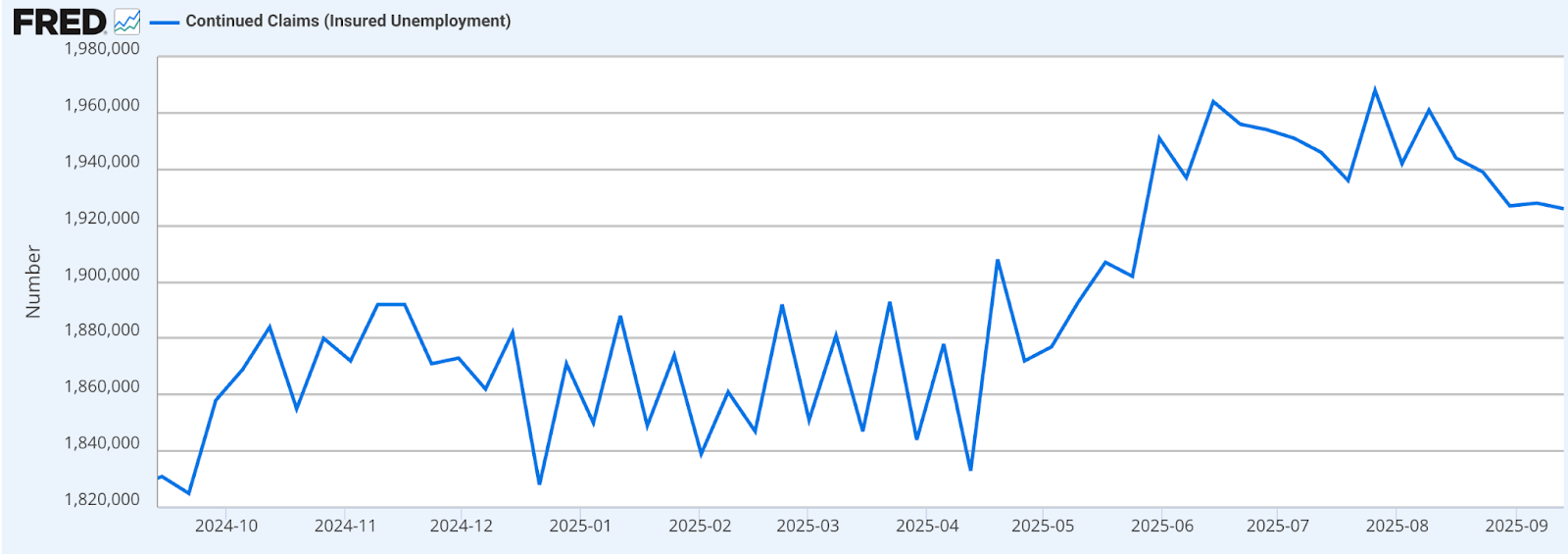

Meanwhile, continuing unemployment claims edged higher to 1.95 million, signaling sluggisher workforce re-entry and persistent strain among federal employees. Claims filed under federal programs reached their highest level since the previous shutdown, a reflection of ongoing job instability within government-linked sectors.

Investor Takeaway

Alternative Indicators Paint a Mixed Picture

Private-sector employment insights from ADP show renewed hiring momentum, with average weekly job creation hovering near 14,250 positions — a rebound from September’s declines. Combined with steady wage growth and improving consumer sentiment, these signals suggest modest optimism in the broader economy.

Online job postings also increased slightly in late October, led by logistics, healthcare, and professional services sectors. Bybit analysts interpret this as a tentative sign of stabilization, though they caution that regional disparities and federal employment volatility could weigh on recovery through Q4.

“The labor market’s durability, even in the absence of federal reporting, reinforces its role as a stabilizer in the U.S. economy,” said one Bybit analyst. “But the uneven pace of hiring and persistent benefit claims point to structural fragilities that could emerge if the shutdown drags on.”

Investor Takeaway

Private Markets Step Into the Policy Void

The Bybit TradFi Report highlights a growing convergence between traditional finance and private analytics firms. Tools such as Bloomberg’s real-time labor dashboards and ADP’s weekly payroll data have become critical to investor decision-making during data blackouts — a trend that underscores the market’s adaptability to uncertainty.

Bybit analysts expect this reliance on private data to persist even later than official releases resume, as institutional investors increasingly integrate alternative data sources into their macro models. The report also suggests that digital finance platforms, including Bybit, are assisting bridge informational gaps by aggregating cross-market insights in real time.

As the U.S. government shutdown stretches into its fifth week, investors continue to weigh the implications for consumer spending, inflation expectations, and risk appetite. For now, the market remains steady — buoyed by cautious optimism and the continued flow of private data-driven intelligence.

The full analysis and accompanying charts are available in the Bybit TradFi Report via the official .