TS Imagine Brings TradeSmart to Temenos Exchange, Expanding Access to Multi-Asset Front-Office Technology

TS Imagine has expanded the reach of its front-office trading technology, announcing that TradeSmart—its cloud-native, multi-asset order and execution management system—is now available on the Temenos platform, the curated marketplace of partner answers integrated with Temenos Core Banking. The move makes TradeSmart accessible to hundreds of banks and financial institutions viewking to upgrade trading capabilities without undertaking full-stack legacy replacements.

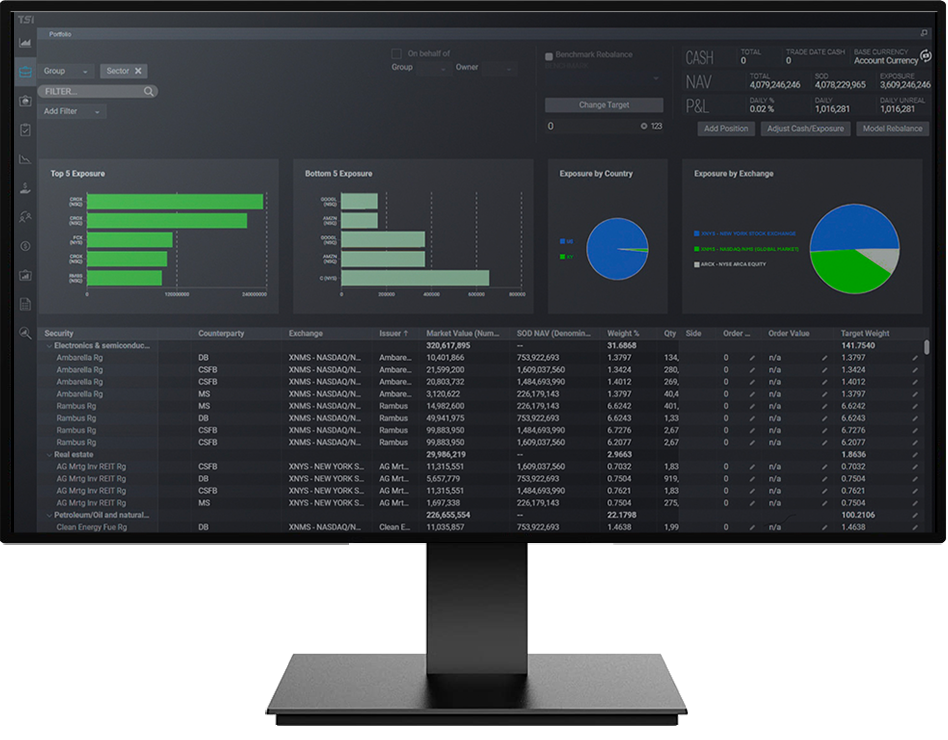

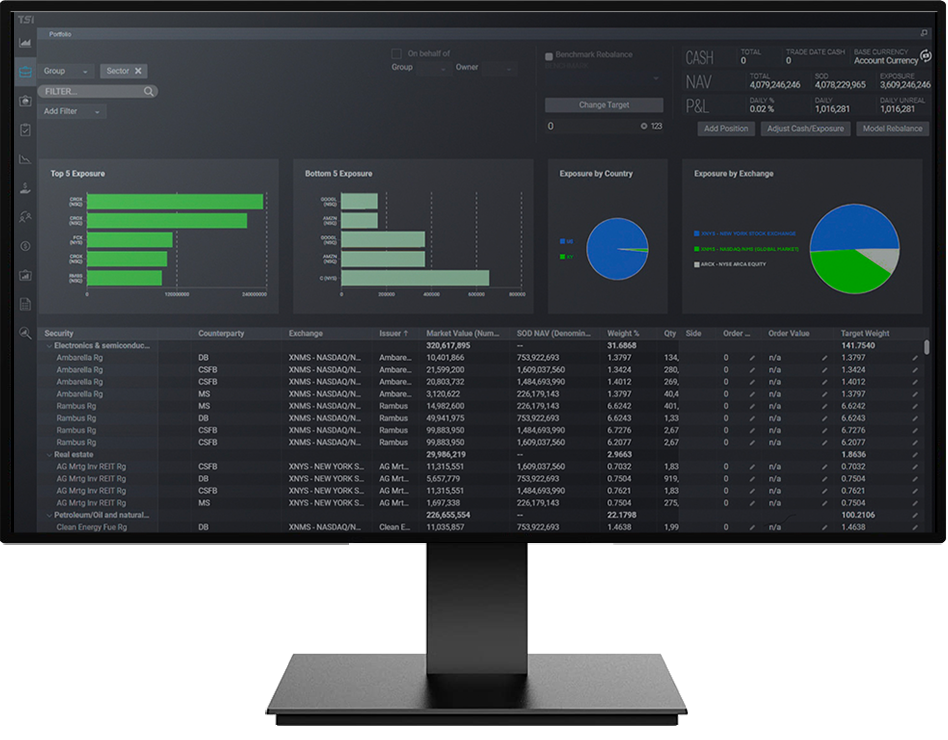

TradeSmart enables institutions to trade across all major asset classes—equities, fixed income, FX, derivatives, and more—within a single workflow. The platform connects clients to TS Imagine’s extensive global network of brokers, liquidity providers and trading venues, while offering , advanced execution algorithms, and analytics spanning more than 25 million financial instruments.

Built as a configurable SaaS platform, TradeSmart benefits from ongoing enhancements delivered by TS Imagine’s global engineering network, allowing users to incorporate new functionality without disruptive upgrades or integration cycles.

Takeaway

Temenos Clients Gain Plug-and-Play Access to Multi-Asset Trading

Temenos platform acts as a central marketplace for banks adopting modular, cloud-ready technology. By adding TradeSmart, Temenos strengthens its portfolio of front-office innovations available to clients looking to workflows.

“We are proud to welcome TS Imagine to Temenos platform,” said Rodrigo Silva, President – Americas at Temenos. “Partners like TS Imagine bring complementary answers that add value to the Temenos platform, empowering our customers to accelerate innovation and transformation.”

For banks already operating on Temenos Core, TradeSmart integration offers a way to enhance institutional trading capabilities—particularly for firms juggling fragmented systems or outdated execution workflows. Through a single screen, institutions can centralize order management, automate trade routing, and simplify complex cross-asset workflows.

Takeaway

TS Imagine Extends Reach Across Global Banking Networks

The listing on Temenos platform marks an significant expansion milestone for TS Imagine, whose answers—TradeSmart, RiskSmart, WealthSmart, and PrimeOne—are used by leading broker-dealers, hedge funds, asset managers and banks worldwide.

“TradeSmart’s availability on the Temenos platform is an significant milestone as we extend access through one of the world’s largest banking partner networks,” said Andrew Morgan, President and Chief Revenue Officer at TS Imagine. “For institutions tackling legacy trading technology, TradeSmart enhances, automates and simplifies complex order workflows through a single screen—cutting complexity and ownership.”

Morgan emphasized that demand for next-generation front-office technology continues to rise as financial institutions pursue , improved risk controls, and competitive execution performance across global markets.

Takeaway