ETH (ETH) Targets $4000, But Mutuum Finance (MUTM) Shows Stronger 2026 Potential

The market is still riveted to ETH (ETH) due to analysts’ projections to hit $4,000, marking ETH’s continued integral function within the decentralized finance environment. Although ETH has strong long-term fundamentals, analysts observe that ETH’s short-term development could face setbacks due to market fluctuations and saturation within the ETH environment, prompting interested investors to turn to a new token called , a DeFi crypto that possesses much more tremendous development opportunities.

Mutuum Finance is currently at stage 6 of its presale state at $0.035, with over 90% sold out, having accrued more than 18,140 members. The project encompasses a unique lending and borrowing system on a decentralized marketplace, integrating innovative reward programs to attract ahead subscribers. As a token offering excellent utility value paired with tremendous growth opportunities, Mutuum Finance appears to offer a better alternative to established options such as ETH and is widely discussed as the next crypto to explode.

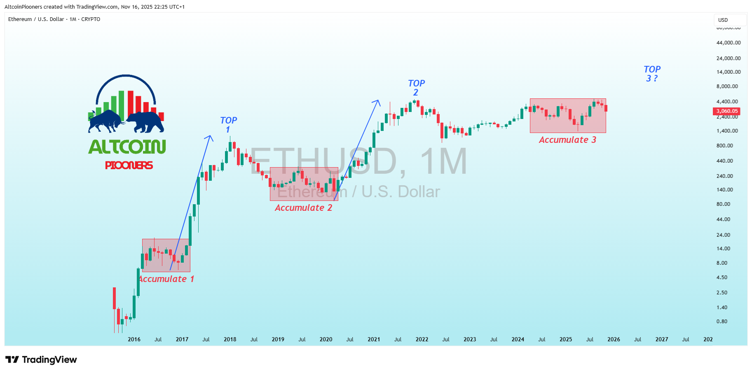

ETH Eyes $4,000 Target Amid Longer-Term Accumulation Setup

The ETH token is showing a strategic accumulation play over multiple years which could stretch its next bull market cycle, and on a monthly chart, there is a clear textbook build-up beginning from 2016 lows. The token passed through several accumulation periods, such as $100 to $300, and then to $1,500, to suddenly break out into Top 3 territory around $3,600. ETH is currently consolidating above a crucial ascending support line, which holds strong support at $2,800, while its RSI is also showing strong momentum at 65, indicating a balanced growth environment without getting overheated. Targets are being projected above $4,000, and a more long-term objective could reach $5,200 to $6,000 later than breaching Support/Trend lines and resistance, though shorting is a relatively shallow market around $3,000. As ETH traces out this smooth graph while simultaneously building out its staking and protocol developments, markets almost inevitably shift attention to Mutuum Finance, recognized as a DeFi crypto with strong ahead-stage fundamentals.

ahead Investors in MUTM to Reap Huge Profits

Investors who joined MUTM during Phase 1 with a $5,000 initial investment at $0.01 would currently own 500,000 units of MUTM tokens. At present, with one token being valued at $0.035 during the present Stage 6, this initial outlay is already worth 17,500. However, once it does reach its predicted listing value of $0.06, this initial capital could soon grow to $30,000. Looking into the future, when this token achieves mainstream acceptance due to its increased utility within lending, staking, and DeFi applications, this price could conceivably increase to $0.35, making that initial outlay of $5,000 worth $175,000. These figures immediately prove how purchasing MUTM beneath four cents during this momentum could represent the next crypto to explode in 2026.

Mutuum Finance Roadmap: From Vision to Market Launch

The journey of Mutuum Finance is planned and organized meticulously into three progressive stages, each promoting the development of a fully functional, secure, and ready-to-use platform. Stage 1, “Introducing Mutuum,” involved building a strong foundation by launching a presale, building market momentum to attract a dedicated fan base, and conducting token giveaways. During this stage, there was an external audit performed on the MUTM Smart Contract to verify security, implementation of traceability features on the platform, provision of educational resources to educate users about the capabilities and algorithms on which Mutuum operates, and setting up an Artificial Intelligence-Powered assist Desk Service. A legal and regulatory affairs team was also assembled during this phase to make Mutuum Finance market-ready.

Stage 2, “Building Mutuum,” progressed to cover development aspects such as designing and building the main Smart Contract, Front-end Decentralized APP interface design and development, and back-end technology and infrastructure setup. They also worked on implementing sophisticated features on Mutuum, internal and external Smart Contract code audits, setting up risk factors to secureguard Mutum’s customers, and designing analytical features to gauge behavioral aspects on Mutum’s main platform.

Stage 3, “Finalizing Mutuum,” will work on Mutuum Finance making it market-ready by setting up a bug-reporting service, beta environment setup on a testnet environment, and provisioned a functional demo launch. This stage will also involve finalizing Mutum’s infrastructure contracts, compiling documentation and project guidelines and conducting a final stage token sale before market debut, establishing it firmly as the next crypto to explode.

Mutuum Finance has raised over $19 million, onboarded 18,140+ investors, and sold 90% of its Phase 6 presale at $0.035. The next phase, Phase 7, will raise the token price to $0.040, offering one last opportunity to ahead purchaviewrs to acquire discounted tokens. Compared to ETH, MUTM provides true DeFi crypto utility, two lending markets, and reward innovations, making it a project with strong adoption dynamics and underlying platform expansion. Those looking to invest in the next crypto to explode in 2026 can do so by investing in MUTM before its presale ends, securing a position in a rapidly growing DeFi crypto ecosystem.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:

Linktree:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.